Hapag-Lloyd reports that its average bunker price fell year-on-year (YoY) by $78, or 11.1 percent, to $625 per tonne during the first half (H1) of 2023.

Bunker consumption in H1 for the German shipping line totalled 1.98m tonnes, which was down 6.6% on the 2.12m tonnes recorded a year earlier. The decrease was said to be due to lower transport volumes, the clearing of congestion in front of ports and lower vessel sailing speeds.

As a result, bunker expenses declined by EUR 225.5m, or 16.5 percent, to EUR 1,141.9m in H1 2023, down from EUR 1,367.4m in the prior-year period.

Hapag-Lloyd: Average Bunker Price (US$/mt), 2019-23| Year | H1 | Q2 |

| 2023 | 625.00 | 603.00 |

| 2022 | 703.00 | 793.00 |

| 2021 | 421.00 | 458.00 |

| 2020 | 448.00 | 360.00 |

| 2019 | 429.00 | 434.00 |

| Year | H1 | Q2 |

| 2023 | 1,141.9 | 519.5 |

| 2022 | 1,367.4 | 786.0 |

| 2021 | 725.3 | 403.5 |

| 2020 | 862.9 | 268.6 |

| 2019 | 822.2 | 427.6 |

| Year | H1 | Q2 |

| 2023 | 1.98 | 0.95 |

| 2022 | 2.12 | 1.06 |

| 2021 | 2.11 | 1.06 |

| 2020 | 2.05 | 0.95 |

| 2019 | 2.20 | 1.10 |

Bunker consumption

Bunker consumption per slot (measured by average container slot capacity, annualised) dipped 10% in H1 to 2.18 tonnes. The improvement was due to efficiency measures and lower bunker consumption, Hapag explained.

Bunker consumption per TEU transported also decreased in H1 — by 3% to 0.34 tonnes.

As regards the consumption of low-sulphur bunker (MFO 0.1% and 0.5%, and distillates) and LNG, Hapag said the H1 figure dipped YoY from 88% to 83% due to the fitting of more vessels with scrubbers.

Key financial results

In its overall results, Hapag-Lloyd posted a H1 profit of $3,133m (down 66.9% on the $9,466m result recorded in H1 2022) and a Q2 profit of $1,102 (77% below last year's figure of $4,782m).

EBITDA of $3,775m in H1 represents a 65.5% drop compared to the previous year's $10,942m result. Second-quarter EBITDA decreased YoY by $4,239m, or 75.2 %, to $1,396m.

Revenue in H1 fell 42% YoY from $18,562m to $10,847m, whilst in Q2 the figure dropped 49.8% from $9,606m to $4,819m.

Transport expenses in H1 were 9.3% below the prior-year level, at $6,330m. This was said to be primarily due a lower bunker consumption price of $625 per tonne and lower demurrage and detention expenses.

|

German ferry operator TT-Line cuts CO2 emissions with bio-LNG switch

TT-Line reports emissions reduction after operating two Baltic Sea ferries on bio-LNG throughout 2025. |

|

|

|

||

|

CMA CGM vessel completes record biomethanol bunkering in Yangshan

Delivery marks first time a vessel in its fleet has operated on biomethanol. |

|

|

|

||

|

Pres-Vac highlights tanker valve compliance requirements for alternative fuels

Company outlines regulatory standards and performance criteria for pressure-vacuum relief devices on methanol and ammonia vessels. |

|

|

|

||

|

ABS and HD Hyundai partner on nuclear propulsion for container ships

Classification society and South Korean shipbuilder to assess feasibility for 16,000-teu vessel. |

|

|

|

||

|

Japan Engine Corporation extends ammonia engine licence to Akasaka Diesels

J-ENG grants domestic partner rights to manufacture alternative-fuel engines for decarbonisation efforts. |

|

|

|

||

|

DNV to host webinar on FuelEU Maritime compliance strategies

Classification society offers insights as first reporting period closes and verification phase begins. |

|

|

|

||

|

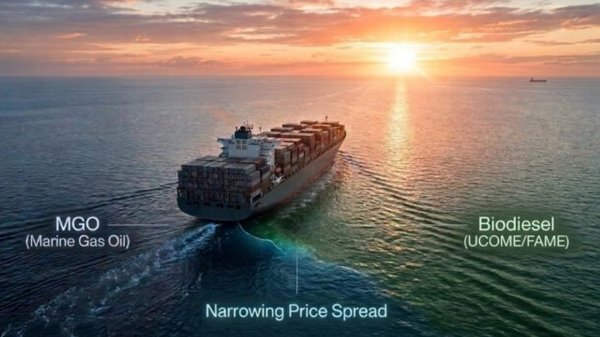

Biodiesel–MGO price spread narrows to $400–500/mt in Northwest Europe

Bunker One says tighter spread creates opportunities for shipping companies pursuing decarbonisation targets. |

|

|

|

||

|

Exmar to discuss ammonia-fuelled vessel operations in webinar

Shipowner will explore safety measures and partnerships for new dual-fuel ammonia carriers. |

|

|

|

||

|

Skuld reports engine damage from CNSL biofuel blends amid rising alternative fuel adoption

Marine insurer details operational challenges with biofuels, including FAME, CNSL and UCOME across member vessels. |

|

|

|

||

|

GRM and Bunker Holding to host webinar on Middle East war's impact on energy markets

Webinar on 9 March will examine effects on crude oil, bunker and gas markets. |

|

|

|

||

| ExxonMobil starts Hapag ARA biofuel deliveries [News & Insights] |