Vitol and Grindrod have announced their decision to wind down Cockett, a company in which they hold equal shares. The move comes after extensive deliberation regarding the "non-core nature" of Cockett's business to both shareholders. The decision, while significant, is said to be aimed at ensuring an orderly and solvent closure of operations.

Cockett, jointly owned by Vitol and Grindrod since 2012, is reported to be in a stable financial position, capable of fulfilling all existing contractual obligations to suppliers and customers throughout the wind-down process. However, as of the announcement, Cockett will cease entering into any new business dealings. The shareholders have emphasised their commitment to a solvent wind-down, anticipating that all relevant suppliers will receive full payment within the next 60 days, in accordance with their supply contracts. Similarly, payments from customers are expected to be settled within the same timeframe.

The wind-down will be managed by Cockett's current leadership, including CEO Cem Saral and CFO Arnaud Payot. Vitol says it will provide support during this transition, leveraging its extensive relationships within the energy sector to aid in the orderly settlement of accounts. A dedicated team will remain to oversee the management of payables and receivables, ensuring a seamless conclusion to operations.

The shareholders expressed their gratitude towards Cockett's employees, acknowledging their professionalism and dedication over the years. It is noted that all staff will receive "considered and responsible compensation" as part of the wind-down process. Furthermore, Vitol and Grindrod thanked Cockett's suppliers and customers for their long-standing support over the past 45 years of trading.

This announcement marks a notable shift for both Vitol and Grindrod, who will redirect their focus towards core business strategies while concluding their involvement with Cockett.

Grindrod bunker profit small compared to core operations

For Grindrod, revenue and profit from marine fuels was not categorized as a core operation in its financial accounts. And even though marine fuel revenue of ZAR 16,043m (US$ 877.8m) in 2023 and ZAR 20,105m ($1,100m) in 2024 was significantly greater than revenue from core operations of ZAR 7,490m ($409.8m) and ZAR 7,371m ($403.3m) in 2023 and 2024, respectively, profit from bunkering activities was actually tiny in comparison.

Grindrod's profit before interest, taxation and non-trading items from marine fuels was only ZAR 46.941m ($2.568m) in 2023 and ZAR 32.170m ($1.760m) in 2024, whilst over the same period, profit from core operations (categorized separately from marine fuels) was ZAR 1,749m ($95.7m) and ZAR 1,296m ($70.9m) in 2023 and 2024, respectively.

Vitol Bunkers

With the divestment of Cockett, which was primarily a bunker trading business, Vitol will be left to focus on its bunker supply operation, Vitol Bunkers.

The company arranges deliveries in Australia, Belgium, China, Maldives, Netherlands, Singapore, South Africa, Turkey, UAE and United States.

|

Elenger enters Polish LNG bunkering market with ferry refuelling operation

Baltic energy firm completes maiden truck-to-ship LNG delivery in Gdansk. |

|

|

|

||

|

SHI develops VR training solutions for Evergreen's methanol-fuelled ships

Shipbuilder creates virtual reality program for 16,500 TEU boxship operations. |

|

|

|

||

|

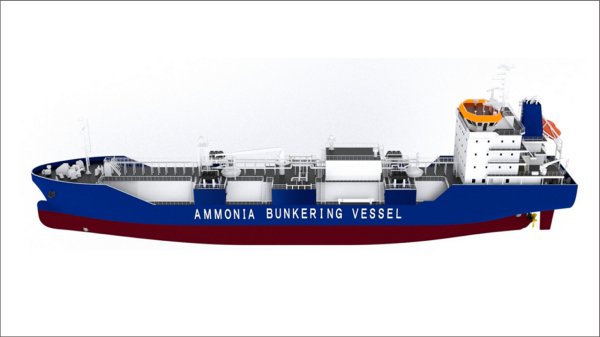

Itochu orders 5,000 cbm ammonia bunker vessel

Japanese firm targets Singapore demonstration after October 2027, with Zeta Bunkering lined up to perform deliveries. |

|

|

|

||

|

Shell completes first LNG bunkering operation with Hyundai Glovis in Singapore

Energy major supplies fuel to South Korean logistics firm's dual-fuel vessel. |

|

|

|

||

|

CPN delivers first B30 marine gasoil to OOCL in Hong Kong

Chimbusco Pan Nation claims to be first in region to supply all grades of ISCC-EU certified marine biofuel. |

|

|

|

||

|

TFG Marine installs first ISO-certified mass flow meter on US Gulf bunker barge

Installation marks expansion of company's digitalisation programme across global fleet. |

|

|

|

||

|

Sogestran's HVO-powered tanker achieves 78% CO2 reduction on French island fuel runs

Small tanker Anatife saves fuel while supplying Belle-Île and Île d'Yeu. |

|

|

|

||

|

Crowley deploys LNG-powered boxship Tiscapa for Caribbean and Central American routes

Vessel is the third in company's Avance Class fleet to enter service. |

|

|

|

||

|

LNG London completes 1,000 bunkering operations in Rotterdam and Antwerp

Delivery vessel reaches milestone after five years of operations across ARA hub. |

|

|

|

||

|

COSCO vessel completes maiden green methanol bunkering at Yangpu

China's first methanol dual-fuel containership refuels with green methanol derived from urban waste. |

|

|

|

||

| Stolt-Nielsen to fully control Avenir LNG with acquisition [Insights] |