|

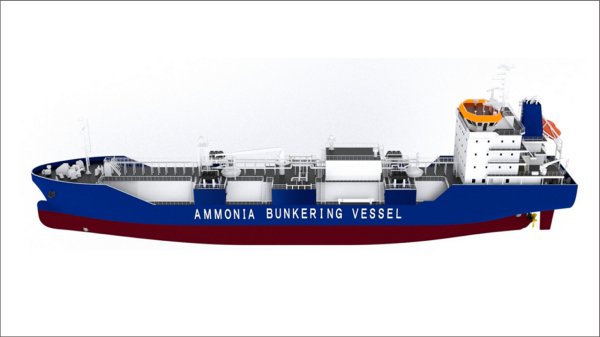

BSM to manage world's first ammonia bunkering vessel for Itochu

German ship manager will provide technical services for 5,000 cbm vessel due in 2027. |

|

|

|

||

|

Baleària switches three ferries to exclusive bio-LNG operation

Spanish ferry operator uses renewable fuel on Barcelona-Alcudia-Ciutadella and Málaga-Melilla routes until December 2025. |

|

|

|

||

|

ReFlow launches lifecycle emissions tool to support decarbonisation decisions

Digital platform simulates vessel emissions from production to operation, helping owners evaluate decarbonisation options. |

|

|

|

||

|

IMO issues training guidelines for seafarers on alternative fuels

International Maritime Organization develops framework to prepare crews for energy transition. |

|

|

|

||

|

IBIA launches follow-up survey on bunker licensing and mass flow meter impact

Survey examines progress since 2022 on fuel quality transparency and regulatory alignment. |

|

|

|

||

|

Malik hires bunker trader for Athens office

Danish supplier adds Nikolas Giannos to its Hellas operation. |

|

|

|

||

|

Greenergy completes acquisition of fuel and lube distributor Armorine

UK firm expands into France following competition clearance to purchase established supplier. |

|

|

|

||

|

Maersk retrofits 200 time-chartered vessels to cut fuel costs and emissions

Shipping giant partners with 50 owners on efficiency programme targeting 35% emissions reduction. |

|

|

|

||

|

MPA declines to renew Brightoil bunker craft operator licence

Brightoil Petroleum will cease operations from November 1 following licence expiry. |

|

|

|

||

|

Sonan Bunkers launches Panama office to expand Americas coverage

Supplier opens hub in Panama City under new Sonan Energy branding. |

|

|

|

||

| Oil and fuel oil hedging market update [News & Insights] |