|

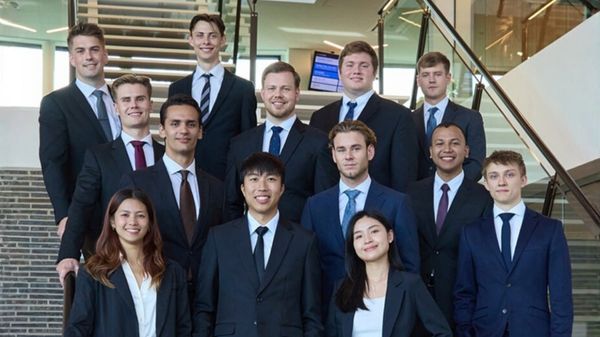

Monjasa opens applications for global trainee programme

Marine fuel supplier seeks candidates for MOST scheme spanning offices from Singapore to New York. |

|

|

|

||

|

Singapore's first fully electric tug completes commissioning ahead of April deployment

PaxOcean and ABB’s 50-tonne bollard-pull vessel represents an early step in harbour craft electrification. |

|

|

|

||

|

Lloyd's Register report examines hydrogen's potential and challenges for decarbonisation

Classification society highlights fuel's promise alongside safety, infrastructure, and cost barriers limiting maritime adoption. |

|

|

|

||

|

BV Malaysia partners with Straits Bio-LNG on sustainable biomethane certification

MoU aims to establish ISCC EU-certified biomethane production and liquefaction facility in strategic alliance. |

|

|

|

||

|

Molgas becomes non-clearing member at European Energy Exchange

Spanish energy company joins EEX as it expands European operations and strengthens shipper role. |

|

|

|

||

|

Diamandopoulos appointed CEO of Elinoil as Aligizakis becomes chairman

Greek marine lube supplier announces leadership changes following board meeting on 5 January. |

|

|

|

||

|

Bureau Veritas to host webinar on sustainable marine fuel transition challenges

Classification society to address regulatory compliance, market trends, and investment strategies in February online event. |

|

|

|

||

|

Inchcape to provide bunkering services from new Indonesian offices

Port agency establishes presence in key bulk and tanker operation hubs handling 150 calls annually. |

|

|

|

||

|

Chimbusco Pan Nation launches B100 biodiesel supply in Hong Kong

Bunker tanker Guo Si becomes Hong Kong's first Type II certified vessel for pure biodiesel operations. |

|

|

|

||

|

Van Oord completes Dutch beach replenishment using 100% bio-LNG

Dredger Vox Apolonia deposited 1 million cbm of sand at Noord-Beveland beach under Coastline Care programme. |

|

|

|

||

| Carnival to save fuel with system upgrade [News & Insights] |

| Operator installs trimming system to cut fuel costs [News & Insights] |

| Cruise line saves fuel with improved design [News & Insights] |

| Royal Caribbean signs deal to improve fuel economy [News & Insights] |