Up to US$180 million investment for BORCO

Parent company says it plans to invest up to US$180 million to upgrade its terminal facility in the Bahamas.

Buckeye Partners, L.P. has announced that it intends to invest up to US$180 million to upgrade its Bahamas Oil Refining Company (BORCO) terminal in 2012.

In an annual report SEC filing, Buckeye said: "We expect to spend approximately $250.0 million to $330.0 million for capital expenditures in 2012, of which approximately $50.0 million to $70.0 million is expected to relate to sustaining capital expenditures and $200.0 million to $260.0 million is expected to relate to expansion and cost reduction projects.

"Approximately $130.0 million to $180.0 million of these amounts are related to capital expenditures in 2012 for the BORCO facility, of which $120.0 million to $160.0 million is expected to relate to expansion projects and $10.0 million to $20.0 million is expected to relate to sustaining capital expenditures.

"Approximately $120.0 million to $150.0 million of these amounts are related to capital expenditures in 2012 for our other assets, excluding the BORCO facility, of which $80.0 million to $100.0 million is expected to relate to expansion projects and $40.0 million to $50.0 million is expected to relate to sustaining capital expenditures. Sustaining capital expenditures include renewals and replacement of pipeline sections, tank floors and tank roofs and upgrades to station and terminalling equipment, field instrumentation and cathodic protection systems.

"Major expansion and cost reduction expenditures in 2012 will include storage tank expansion projects at the BORCO facility, completion of additional storage tanks and rail loading facilities in the Midwest, the refurbishment of storage tanks and facilities in the Northeast, continued installation of vapor recovery units throughout our system of terminals, additive system installation throughout our terminal infrastructure and various upgrades and expansions of our ethanol business. Cost reduction expenditures improve operational efficiencies or reduce costs."

BORCO’s terminal facility includes 80 aboveground storage tanks with a storage capacity of approximately 21.4 million barrels. The existing marine infrastructure of BORCO’s terminal facility consists of three deep-water jetties. With recent completion of a refurbishment project on one of the jetties, commissioned in December 2011, the three jetties will provide six deep-water berths that serve as the access points to the storage facilities and are capable of handling both very large crude carriers and ultra large crude carriers. BORCO currently has a long term agreement through 2057 with the Bahamas Government to lease 330 acres of seabed on which the jetties are located.

BORCO’s terminal facility also includes an inland dock located in Freeport Harbor with two berths. BORCO currently leases the inland dock from the Freeport Harbour Company under a long-term agreement through 2067.

Storage revenue

Storage revenue represented approximately 80% of BORCO’s total revenue for the year ended December 31, 2011. Currently, BORCO has a limited number of long-term storage customers, consisting of oil majors, energy companies, physical traders and one national oil company.

For the year ended December 31, 2011, approximately 27% and 58% of storage revenue was derived from the top one and the top three customers, respectively. Buckeye said it expects BORCO to continue to derive substantially all of its total revenue from a small number of customers in the future.

"BORCO may be unsuccessful in renewing its storage contracts with its customers, and those customers may discontinue or reduce contracted storage from BORCO. If any of BORCO’s customers, in particular its top three customers, significantly reduces its contracted storage with BORCO and if BORCO is unable to find other storage customers on terms," Buckeye said.

Venezuelan risk

A substantial portion of BORCO’s revenue relates to petroleum products exported from Venezuela by Petróleos de Venezuela, S.A. (PDVSA). Commenting on the issue, Buckeye said: "This involvement with products exported from Venezuela exposes BORCO to significant risks, including potential political and economic instability and trade restrictions and economic embargoes imposed by the United States and other countries."

Future outlook

Buckeye said that results for its international operations segment results in 2011 were adversely impacted by lower than expected berthing revenue due to reductions in availability of fuel oil blending components, which was primarily down to operational issues at a refinery in the U.S. Virgin Islands and lower vessel traffic as inventory optimization opportunities were limited given market conditions. These market conditions also created some weakness in demand for product storage in 2011.

Looking forward to 2012 and beyond, Buckeye said it is seeing increased customer interest for both crude and refined product storage. Near- term crude demand has increased following the announcement of the shutdown of the Caribbean refinery and longer term demand is being driven by the ramp up of crude production in South America.

"We believe the closure of the Caribbean refinery and the continued rationalization of Northeast refineries position BORCO to capitalize on increased demand for refined product storage as customers re-work their logistics chains to respond to changing supply patterns. We may experience some softness in demand for berthing and other ancillary services if the forward product pricing does not create inventory optimization opportunities for our customers, although we do not expect the lack of availability of blending components to impact 2012 as our customer has secured an alternate source of supply. BORCO is also expected to benefit in 2012 as the first phase of our expansion project begins to come on-line in the second half of the year," Buckeye said.

In an annual report SEC filing, Buckeye said: "We expect to spend approximately $250.0 million to $330.0 million for capital expenditures in 2012, of which approximately $50.0 million to $70.0 million is expected to relate to sustaining capital expenditures and $200.0 million to $260.0 million is expected to relate to expansion and cost reduction projects.

"Approximately $130.0 million to $180.0 million of these amounts are related to capital expenditures in 2012 for the BORCO facility, of which $120.0 million to $160.0 million is expected to relate to expansion projects and $10.0 million to $20.0 million is expected to relate to sustaining capital expenditures.

"Approximately $120.0 million to $150.0 million of these amounts are related to capital expenditures in 2012 for our other assets, excluding the BORCO facility, of which $80.0 million to $100.0 million is expected to relate to expansion projects and $40.0 million to $50.0 million is expected to relate to sustaining capital expenditures. Sustaining capital expenditures include renewals and replacement of pipeline sections, tank floors and tank roofs and upgrades to station and terminalling equipment, field instrumentation and cathodic protection systems.

"Major expansion and cost reduction expenditures in 2012 will include storage tank expansion projects at the BORCO facility, completion of additional storage tanks and rail loading facilities in the Midwest, the refurbishment of storage tanks and facilities in the Northeast, continued installation of vapor recovery units throughout our system of terminals, additive system installation throughout our terminal infrastructure and various upgrades and expansions of our ethanol business. Cost reduction expenditures improve operational efficiencies or reduce costs."

BORCO’s terminal facility includes 80 aboveground storage tanks with a storage capacity of approximately 21.4 million barrels. The existing marine infrastructure of BORCO’s terminal facility consists of three deep-water jetties. With recent completion of a refurbishment project on one of the jetties, commissioned in December 2011, the three jetties will provide six deep-water berths that serve as the access points to the storage facilities and are capable of handling both very large crude carriers and ultra large crude carriers. BORCO currently has a long term agreement through 2057 with the Bahamas Government to lease 330 acres of seabed on which the jetties are located.

BORCO’s terminal facility also includes an inland dock located in Freeport Harbor with two berths. BORCO currently leases the inland dock from the Freeport Harbour Company under a long-term agreement through 2067.

Storage revenue

Storage revenue represented approximately 80% of BORCO’s total revenue for the year ended December 31, 2011. Currently, BORCO has a limited number of long-term storage customers, consisting of oil majors, energy companies, physical traders and one national oil company.

For the year ended December 31, 2011, approximately 27% and 58% of storage revenue was derived from the top one and the top three customers, respectively. Buckeye said it expects BORCO to continue to derive substantially all of its total revenue from a small number of customers in the future.

"BORCO may be unsuccessful in renewing its storage contracts with its customers, and those customers may discontinue or reduce contracted storage from BORCO. If any of BORCO’s customers, in particular its top three customers, significantly reduces its contracted storage with BORCO and if BORCO is unable to find other storage customers on terms," Buckeye said.

Venezuelan risk

A substantial portion of BORCO’s revenue relates to petroleum products exported from Venezuela by Petróleos de Venezuela, S.A. (PDVSA). Commenting on the issue, Buckeye said: "This involvement with products exported from Venezuela exposes BORCO to significant risks, including potential political and economic instability and trade restrictions and economic embargoes imposed by the United States and other countries."

Future outlook

Buckeye said that results for its international operations segment results in 2011 were adversely impacted by lower than expected berthing revenue due to reductions in availability of fuel oil blending components, which was primarily down to operational issues at a refinery in the U.S. Virgin Islands and lower vessel traffic as inventory optimization opportunities were limited given market conditions. These market conditions also created some weakness in demand for product storage in 2011.

Looking forward to 2012 and beyond, Buckeye said it is seeing increased customer interest for both crude and refined product storage. Near- term crude demand has increased following the announcement of the shutdown of the Caribbean refinery and longer term demand is being driven by the ramp up of crude production in South America.

"We believe the closure of the Caribbean refinery and the continued rationalization of Northeast refineries position BORCO to capitalize on increased demand for refined product storage as customers re-work their logistics chains to respond to changing supply patterns. We may experience some softness in demand for berthing and other ancillary services if the forward product pricing does not create inventory optimization opportunities for our customers, although we do not expect the lack of availability of blending components to impact 2012 as our customer has secured an alternate source of supply. BORCO is also expected to benefit in 2012 as the first phase of our expansion project begins to come on-line in the second half of the year," Buckeye said.

|

Martin Vorgod elevated to CEO of Global Risk Management

Vorgod, currently CCO at GRM, will officially step in as CEO on December 1, succeeding Peder Møller. |

|

|

|

||

|

Dorthe Bendtsen named interim CEO of KPI OceanConnect

Officer with background in operations and governance to steer firm through transition as it searches for permanent leadership. |

|

|

|

||

|

Bunker Holding revamps commercial department and management team

CCO departs; commercial activities divided into sales and operations. |

|

|

|

||

|

Peninsula extends UAE coverage into Abu Dhabi and Jebel Ali

Supplier to provide 'full range of products' after securing bunker licences. |

|

|

|

||

|

Peninsula to receive first of four tankers in Q2 2025

Methanol-ready vessels form part of bunker supplier's fleet renewal programme. |

|

|

|

||

|

Stephen Robinson heads up bunker desk at Tankers International

Former Bomin and Cockett MD appointed Head of Bunker Strategy and Procurement. |

|

|

|

||

|

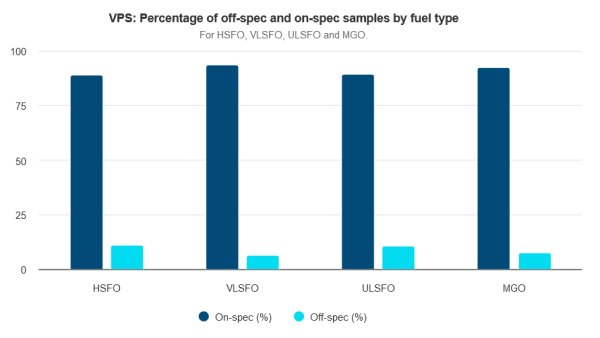

Is your vessel fully protected from the dangers of poor-quality fuel? | Steve Bee, VPS

Commercial Director highlights issues linked to purchasing fuel and testing quality against old marine fuel standards. |

|

|

|

||

|

GDE Marine targets Suape LSMGO by year-end

Expansion plan revealed following '100% incident-free' first month of VLSFO deliveries. |

|

|

|

||

|

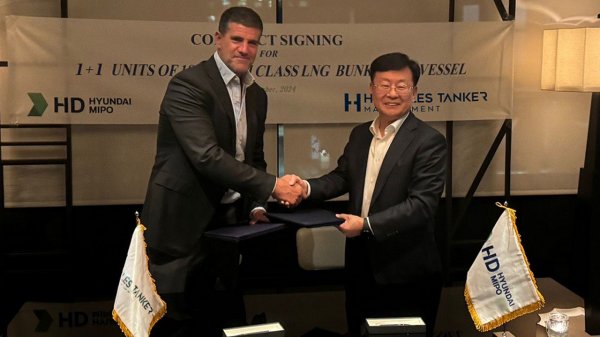

Peninsula CEO seals deal to build LNG bunker vessel

Agreement signed through shipping company Hercules Tanker Management. |

|

|

|

||

|

Auramarine supply system chosen for landmark methanol-fuelled tugs

Vessels to enter into service in mid-2025. |

|

|

|

||

Related Links

- · First vessel call at new BORCO jetty [Insights]

- · Buckeye acquires oil terminals in Maine [Insights]

- · BORCO awards storage tank project [Insights]

- · Buckeye to expand BORCO facility [Insights]

- · Bahamas [Directory]

- · Freeport [Directory]