| Fuel type | On-spec (%) | Off-spec (%) |

|---|---|---|

| HSFO | 89.1 | 10.9 |

| VLSFO | 93.7 | 6.3 |

| ULSFO | 89.4 | 10.6 |

| MGO | 92.3 | 7.7 |

As the global marine fuel mix grows, becoming more varied and, consequently, more complex in terms of fuel management, there is a potential increasing risk to vessels, crew and the environment from the possible impact of poor-quality fuels.

Yet, whilst shipping looks to decarbonise with a view to introducing low-to-zero carbon fuels, such as biofuels and methanol, these fuels currently account for approximately 1% of the fuel mix. The more traditional fossil fuels are continuing to satisfy the day-to-day demand in terms of fuels supplied to vessels at this time, with almost 230 million MT of marine fuels being bunkered last year.

The VPS database shows that for all fossil fuels tested, the current off-specifications have been identified (see chart above).

VPS Bunker Alerts are also a good indication of current fuel quality; and so far to date, VPS has issued 21 Bunker Alerts this year. These alerts have highlighted quality issues with the three main fuel types of HSFO (6 alerts), VLSFO (9 alerts) and MGO (6 alerts). The 2024 alerts show significant off-specifications for 8 different test parameters from 11 different locations, across Europe, Middle-East, Asia and the Americas. This proves fuel quality issues can arise anywhere at any time, for any fuel type or test parameter.

June 2024 saw the 7th revision of the marine fuel standard ISO 8217, released to the industry. ISO 8217:2024 is seen as a major step forward in terms of setting specifications for marine fuel quality. This latest revision has moved from two fuel specification tables to four. It now includes, for the first time, specifications for VLSFO and ULSFO fuels containing 0.50% or 0.10% sulphur, respectively, plus biofuels containing FAME, HVO, GTL, BTL, bio-components.

Acknowledging that ISO 8217:2024 is an improvement on previous revisions of the standard, it still does not cover enough of the further potentially problematic issues of chemical contamination, cold flow properties, microbial growth, plus wider bio-components such as Cashew Nut Shell Liquid (CNSL), to name but a few areas of concern.

In addition, the industry has a very poor track record of purchasing fuel against the very latest revision of the ISO 8217 standard. To date, VPS, as the world's largest marine fuel quality testing company, still sees 12.6% of samples received for quality testing being purchased against the 2005 revision of the standard. So, vessels are purchasing fuel against a standard which is actually only three months from being 20 years old. That revision has since been replaced by four further revisions of the standard over the years, and it bears very little relevance to today's fuels. Therefore, these vessels are really operating at a significantly increased level of risk if they are relying on ISO 8217:2005 to fully protect them.

The most common revision against which marine fuel is purchased today is still ISO 8217:2010. Currently, 48% of all fuel samples received by VPS are being tested against this revision. Again, ISO 8217:2010 is almost 15 years old, so why is almost half of the fuel being purchased to it? There is no consideration of VLSFO, or ULSFO fuels, with FAME also being classed as a contaminant.

The 2017 revision still only accounts for 20% of the fuel samples VPS receives for testing even though it's nearly eight years old. However, it does consider the presence of FAME within certain distillate grades but still offers no specification for the lower-sulphur grades of residual-based fuels, where VLSFOs are the most widely purchased fuel type.

| Fuel Standard | Percentage of total fuel samples |

|---|---|

| ISO 8217:2005 | 12.6 |

| ISO 8217:2010 | 47.7 |

| ISO 8217:2012 | 19.3 |

| ISO 8217:2017 | 20.4 |

All this means that the global fleet is buying fuel and testing its quality against a standard which is between 8-20 years old.

To date, VPS has not received a fuel sample, fossil fuel, or biofuel purchased to the 2024 revision. Based on past history, it may be some time before such a sample is received. Even then, ISO 8217:2024, whilst a major improvement to previous revisions, is not an all-encompassing standard.

As far back as 2018, The Swedish Club released its independent report 'Main Engine Damage'. This report highlighted how to avoid engine damage, including information showing the average cost of a single fuel management incident on board a vessel was $344,069. It also stated the average cost of a single lubrication failure was $763,320.

The Swedish Club's advice and recommendations were:

How to avoid main engine damage

- Implement robust onboard fuel and lubrication oil management systems.

- Carry out drip sampling when bunkering. Avoid consuming the fuel until analysis results are available.

- In addition to onboard testing of lubrication oil, submit samples for laboratory analysis at regular intervals, at least every third month.

- At regular intervals, carry out system checks of purifiers and filters for both fuel and lubrication oil systems.

Back in 2019, in the lead up to IMO 2020 and the reduction in the global sulphur cap to 0.50%, VPS foresaw potential quality issues with the new incoming VLSFO fuels. These fuels would be of higher paraffinic content, leading to poorer cold flow behaviour, potential wax precipitation and major stability issues. VPS recognised that the ISO 8217 standard did not provide sufficient protection to a vessel when using VLSFO, or even HSFO and MGO fuels.

Therefore, the VPS Additional Protection (APS) service was launched prior to 2020. This service offers the full ISO 8217 test scope, plus a number of additional tests, in one package offering, at a significantly reduced price, in order to ensure a greater level of protection to vessels and enhanced peace of mind to the — now more informed — operator using this service.

The APS Package is customised, by fuel type, to cover HSFO, VLSFO, or distillates. The additional tests included will provide much more information and greater understanding of the fuel in relation to stability, chemical contamination, cold flow properties, lubricity and microbial activity. The package can also be further customised to individual customer requirements. Many VPS customers have used — and continue to use — APS to mitigate the potential risks from poor quality fuel and benefit from the added value and cost savings the service delivers.

In 2022, the incoming range of marine biofuels warranted VPS to research a number of different additional tests to assist in identifying biofuel management issues and understanding their behaviour and operational risks. As a consequence, VPS launched the APS-BIO packages. Once again, these include ISO 8217 as a base test slate and also include additional tests to measure energy content, stability, renewable content, microbial-activity, corrosivity and cold flow properties. The APS-BIO suite of test slates cover different bio-components such as FAME, HVO, CNSL, plus the fossil fuels used in a bio blend, such as HSFO, VLSFO and MGO.

|

Ammonia emerges as most feasible alternative fuel for deep-sea shipping in 2050 emissions study

Research combining expert survey and technical analysis ranks ammonia ahead of hydrogen and methanol. |

|

|

|

||

|

EMSA study examines biodiesel blend spill response as shipping adopts alternative fuels

Research addresses knowledge gaps on biodiesel-conventional fuel blends as marine pollutants and response measures. |

|

|

|

||

|

BIMCO adopts ETS clause for bareboat charters, delays biofuel provision

BIMCO’s Documentary Committee has approved an emissions trading compliance clause while requesting further work on a biofuel charter provision. |

|

|

|

||

|

BIMCO and Norwegian Shipbrokers’ Association launch SALEFORM 2025 ship sale contract

Updated agreement addresses banking changes, compliance requirements and environmental regulations affecting vessel transactions. |

|

|

|

||

|

Everllence develops hydrogen test bench for marine engines

German engine maker upgrades Augsburg facility under HydroPoLEn project backed by federal maritime research funding. |

|

|

|

||

|

CMA CGM names 13,000-teu methanol-fuelled containership in South Korea

CMA CGM Osmium to operate on Asia–Mexico service as part of the carrier’s decarbonisation strategy. |

|

|

|

||

|

NorthStandard publishes biofuel guide as marine insurance claims emerge

White paper addresses quality issues and compliance requirements as biofuel testing volumes surge twelvefold. |

|

|

|

||

|

Maritime fuel platform calls for EU shipping ETS revenues to fund clean fuel deployment

Clean Maritime Fuels Platform urges earmarking of national emissions trading revenues for renewable fuel infrastructure. |

|

|

|

||

|

Lloyd’s Register grants approval for hybrid nuclear power design for amphibious vessels

Classification society approves Seatransport’s concept integrating micro modular reactors with diesel-electric systems. |

|

|

|

||

|

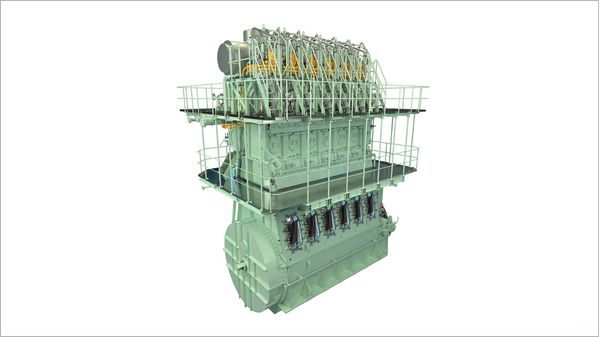

Everllence and Vale partner on ethanol-powered marine engine development

Brazilian mining company to develop dual-fuel ethanol engines based on ME-LGI platform. |

|

|

|

||

| ISO 8217:2024 'a major step forward' | Steve Bee, VPS [News & Insights] |

| ISO 8217 formula 'not suitable' for gauging FAME fuel energy content: VPS [News & Insights] |

| VPS performs first methanol bunker quantity survey [News & Insights] |

| VPS launches VLSFO test method for wax appearance temperature [News & Insights] |