Kirby net income up 42.3 percent

Oil transportation firm reports strong tank barge utilization and improved barging rates in Q2.

Kirby Corporation has announced that net earnings rose by US$12.4 million, or 42.3 percent, year-on-year during the second quarter ended June 30, 2011.

Net earnings for the period was $41.7 million, or $.77 per share, compared with $29.3 million, or $.54 per share, for the 2010 second quarter.

Consolidated revenues for the 2011 second quarter were $437.3 million compared with $273.7 million for the 2010 second quarter, representing a rise of US$163.6 million, or 59.8 percent.

Commenting on the results, Joe Pyne, Kirby’s Chairman and Chief Executive Officer, said, “Our second quarter results reflected continued strong tank barge utilization and an improvement in barging rates as United States petrochemical production remained strong and refinery utilization stable. We are also beginning to see new demand for crude oil transportation from shale formations in South Texas. In addition, we had a positive contribution from United Holdings LLC, our land-based distributor and service provider of engine and transmission related products and manufacturer of oilfield service equipment acquired on April 15, 2011. These positive results were partially offset by the negative impact of the record high water and flooding conditions throughout the Mississippi River System during the quarter.”

Pyne continued, “In addition to the United acquisition, on July 1 we successfully expanded our marine transportation footprint with the acquisition of K-Sea Transportation Partners L.P., an operator of tank barges and tugboats participating in United States coastwise transportation of primarily refined petroleum products.”

For the first six months of 2011 net income climbed US$20.2 million, or 37.5 percent, to $74.1 million, or $1.38 per share, compared with $53.9 million, or $1.00 per share, in the first half of 2010.

Consolidated revenues for the first half of the year were up US$194.8 million, or 35.9 percent, to $736.7 million compared with $541.9 million in 2010.

Segment Results – Marine Transportation

Marine transportation revenues for the 2011 second quarter were $266.6 million, a 16 percent increase compared with the 2010 second quarter, and operating income was $58.4 million, representing an 18 percent increase compared with the second quarter of 2010. Tank barge utilization for the petrochemical and black oil products fleets remained at low-to-mid 90 percent levels.

Low natural gas prices continued to positively impact the global competitiveness of the United States petrochemical industry, leading to higher petrochemical production levels and corresponding increased marine transportation volumes for both domestic consumers and terminals for export destinations. The black oil products market remained favorable, driven by the continued exportation of heavy fuel oil and new demand for the transportation of crude oil principally from the Eagle Ford shale formations in South Texas.

Diesel fuel prices for the 2011 second quarter increased 42 percent compared with the 2010 second quarter, thereby positively impacting marine transportation revenues since fuel price increases are covered by fuel escalation and de-escalation clauses in term contracts.

The marine transportation operating margin for the 2011 second quarter was 21.9 percent compared with 21.6 percent for the second quarter of 2010, a reflection of continued strong petrochemical and black oil products demand and equipment utilization levels, and higher term and spot market pricing, partially offset by the cost impact of the high water and flooding during the majority of the quarter and the cost impact of rising diesel fuel prices.

Outlook

Commenting on the 2011 third quarter and full year market outlook and guidance, Pyne said, “Our earnings guidance for the 2011 third quarter is $.82 to $.87 per share, a 44 percent to 53 percent increase compared with $.57 per share reported for the 2010 third quarter. Our third quarter guidance range reflects the continuation of the second quarter’s strong petrochemical and black oil products demand, favorable term and spot contract rate increases and strong demand for the manufacturing of hydraulic fracturing equipment. These will be partially offset by fewer power generation engine-generator set upgrade projects and lower results from our four offshore dry-bulk barge and tug units with one unit in the shipyard for a portion of the quarter.

"The third quarter guidance includes positive earnings from K-Sea, offset by estimated one-time K-Sea acquisition transaction costs of $.03 per share, and higher interest expense and higher common shares outstanding associated with the K-Sea acquisition. For the 2011 year, we are raising and tightening our earnings per share guidance to $3.00 to $3.10 from previous guidance of $2.70 to $2.90 per share.”

Pyne continued, “Our 2011 capital spending guidance range was updated to $225 to $235 million, including approximately $120 million for the construction of 40 inland tank barges and two inland towboats and progress payments on 2012 inland tank barge and towboat construction. The guidance range also includes approximately $35 million in progress payments on the construction of two offshore integrated dry-bulk barge and tugboat units scheduled for delivery in 2012 with an estimated cost of $50 million each.”

K-Sea Acquisition

On July 1, 2011, Kirby purchased K-Sea Transportation Partners L.P (K-Sea), an operator of tank barges and tugboats participating in the coastwise transportation primarily of refined petroleum products in the United States. The total consideration of the transaction was approximately $604 million, excluding transaction fees, consisting of $228 million in cash paid to K-Sea common and preferred unit holders and the general partner, $263 million of cash to retire K-Sea’s outstanding debt, and $113 million through the issuance of approximately 1,939,000 shares of Kirby common stock valued at $58.28 per share, Kirby’s closing share price on July 1, 2011. The acquisition was financed through a combination of a new $540 million bank term loan and the issuance of Kirby common stock.

K-Sea’s fleet, comprised of 58 tank barges with a capacity of 3.8 million barrels and 63 tugboats, operates along the East Coast, West Coast and Gulf Coast of the United States, as well as in Alaska and Hawaii. K-Sea’s tank barge fleet, 54 of which are double hull, has an average age of approximately nine years and is one of the youngest fleets in the coastwise trade.

K-Sea’s customers include major oil companies and refiners, many of which are current Kirby customers for inland tank barge services. K-Sea has major operating facilities in New York, Philadelphia, Norfolk, Seattle and Honolulu.

Net earnings for the period was $41.7 million, or $.77 per share, compared with $29.3 million, or $.54 per share, for the 2010 second quarter.

Consolidated revenues for the 2011 second quarter were $437.3 million compared with $273.7 million for the 2010 second quarter, representing a rise of US$163.6 million, or 59.8 percent.

Commenting on the results, Joe Pyne, Kirby’s Chairman and Chief Executive Officer, said, “Our second quarter results reflected continued strong tank barge utilization and an improvement in barging rates as United States petrochemical production remained strong and refinery utilization stable. We are also beginning to see new demand for crude oil transportation from shale formations in South Texas. In addition, we had a positive contribution from United Holdings LLC, our land-based distributor and service provider of engine and transmission related products and manufacturer of oilfield service equipment acquired on April 15, 2011. These positive results were partially offset by the negative impact of the record high water and flooding conditions throughout the Mississippi River System during the quarter.”

Pyne continued, “In addition to the United acquisition, on July 1 we successfully expanded our marine transportation footprint with the acquisition of K-Sea Transportation Partners L.P., an operator of tank barges and tugboats participating in United States coastwise transportation of primarily refined petroleum products.”

For the first six months of 2011 net income climbed US$20.2 million, or 37.5 percent, to $74.1 million, or $1.38 per share, compared with $53.9 million, or $1.00 per share, in the first half of 2010.

Consolidated revenues for the first half of the year were up US$194.8 million, or 35.9 percent, to $736.7 million compared with $541.9 million in 2010.

Segment Results – Marine Transportation

Marine transportation revenues for the 2011 second quarter were $266.6 million, a 16 percent increase compared with the 2010 second quarter, and operating income was $58.4 million, representing an 18 percent increase compared with the second quarter of 2010. Tank barge utilization for the petrochemical and black oil products fleets remained at low-to-mid 90 percent levels.

Low natural gas prices continued to positively impact the global competitiveness of the United States petrochemical industry, leading to higher petrochemical production levels and corresponding increased marine transportation volumes for both domestic consumers and terminals for export destinations. The black oil products market remained favorable, driven by the continued exportation of heavy fuel oil and new demand for the transportation of crude oil principally from the Eagle Ford shale formations in South Texas.

Diesel fuel prices for the 2011 second quarter increased 42 percent compared with the 2010 second quarter, thereby positively impacting marine transportation revenues since fuel price increases are covered by fuel escalation and de-escalation clauses in term contracts.

The marine transportation operating margin for the 2011 second quarter was 21.9 percent compared with 21.6 percent for the second quarter of 2010, a reflection of continued strong petrochemical and black oil products demand and equipment utilization levels, and higher term and spot market pricing, partially offset by the cost impact of the high water and flooding during the majority of the quarter and the cost impact of rising diesel fuel prices.

Outlook

Commenting on the 2011 third quarter and full year market outlook and guidance, Pyne said, “Our earnings guidance for the 2011 third quarter is $.82 to $.87 per share, a 44 percent to 53 percent increase compared with $.57 per share reported for the 2010 third quarter. Our third quarter guidance range reflects the continuation of the second quarter’s strong petrochemical and black oil products demand, favorable term and spot contract rate increases and strong demand for the manufacturing of hydraulic fracturing equipment. These will be partially offset by fewer power generation engine-generator set upgrade projects and lower results from our four offshore dry-bulk barge and tug units with one unit in the shipyard for a portion of the quarter.

"The third quarter guidance includes positive earnings from K-Sea, offset by estimated one-time K-Sea acquisition transaction costs of $.03 per share, and higher interest expense and higher common shares outstanding associated with the K-Sea acquisition. For the 2011 year, we are raising and tightening our earnings per share guidance to $3.00 to $3.10 from previous guidance of $2.70 to $2.90 per share.”

Pyne continued, “Our 2011 capital spending guidance range was updated to $225 to $235 million, including approximately $120 million for the construction of 40 inland tank barges and two inland towboats and progress payments on 2012 inland tank barge and towboat construction. The guidance range also includes approximately $35 million in progress payments on the construction of two offshore integrated dry-bulk barge and tugboat units scheduled for delivery in 2012 with an estimated cost of $50 million each.”

K-Sea Acquisition

On July 1, 2011, Kirby purchased K-Sea Transportation Partners L.P (K-Sea), an operator of tank barges and tugboats participating in the coastwise transportation primarily of refined petroleum products in the United States. The total consideration of the transaction was approximately $604 million, excluding transaction fees, consisting of $228 million in cash paid to K-Sea common and preferred unit holders and the general partner, $263 million of cash to retire K-Sea’s outstanding debt, and $113 million through the issuance of approximately 1,939,000 shares of Kirby common stock valued at $58.28 per share, Kirby’s closing share price on July 1, 2011. The acquisition was financed through a combination of a new $540 million bank term loan and the issuance of Kirby common stock.

K-Sea’s fleet, comprised of 58 tank barges with a capacity of 3.8 million barrels and 63 tugboats, operates along the East Coast, West Coast and Gulf Coast of the United States, as well as in Alaska and Hawaii. K-Sea’s tank barge fleet, 54 of which are double hull, has an average age of approximately nine years and is one of the youngest fleets in the coastwise trade.

K-Sea’s customers include major oil companies and refiners, many of which are current Kirby customers for inland tank barge services. K-Sea has major operating facilities in New York, Philadelphia, Norfolk, Seattle and Honolulu.

|

Martin Vorgod elevated to CEO of Global Risk Management

Vorgod, currently CCO at GRM, will officially step in as CEO on December 1, succeeding Peder Møller. |

|

|

|

||

|

Dorthe Bendtsen named interim CEO of KPI OceanConnect

Officer with background in operations and governance to steer firm through transition as it searches for permanent leadership. |

|

|

|

||

|

Bunker Holding revamps commercial department and management team

CCO departs; commercial activities divided into sales and operations. |

|

|

|

||

|

Peninsula extends UAE coverage into Abu Dhabi and Jebel Ali

Supplier to provide 'full range of products' after securing bunker licences. |

|

|

|

||

|

Peninsula to receive first of four tankers in Q2 2025

Methanol-ready vessels form part of bunker supplier's fleet renewal programme. |

|

|

|

||

|

Stephen Robinson heads up bunker desk at Tankers International

Former Bomin and Cockett MD appointed Head of Bunker Strategy and Procurement. |

|

|

|

||

|

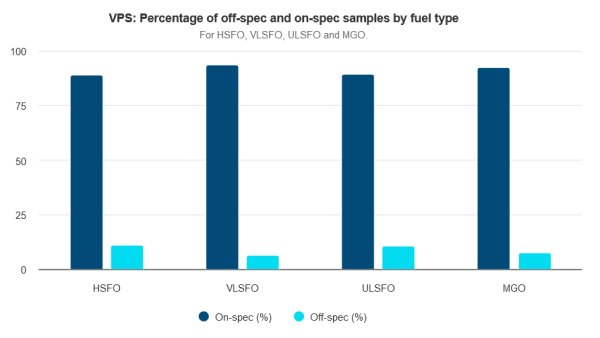

Is your vessel fully protected from the dangers of poor-quality fuel? | Steve Bee, VPS

Commercial Director highlights issues linked to purchasing fuel and testing quality against old marine fuel standards. |

|

|

|

||

|

GDE Marine targets Suape LSMGO by year-end

Expansion plan revealed following '100% incident-free' first month of VLSFO deliveries. |

|

|

|

||

|

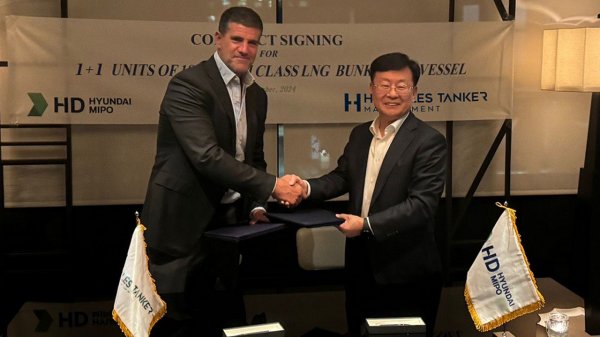

Peninsula CEO seals deal to build LNG bunker vessel

Agreement signed through shipping company Hercules Tanker Management. |

|

|

|

||

|

Auramarine supply system chosen for landmark methanol-fuelled tugs

Vessels to enter into service in mid-2025. |

|

|

|

||

Related Links

- · Kirby completes acquisition of K-Sea [Insights]

- · Kirby acquires K-Sea Transportation [Insights]

- · Second acquisition for Kirby [Insights]

- · Drop in net earnings for US barge operator [Insights]

- · United States [Directory]