|

With the European Union ruling that its Emissions Trading System (ETS) will include shipping from January 1, 2024, the impact that this will have on non-EU nations and shippers is being keenly anticipated. The system will be based on the route of the ship, meaning that voyages between ports within the EU will have 100% of their emissions included in the ETS, whilst ships starting or ending their journey outside of the EU, 50%.

This has led some critics to suggest that there would be an increase in the use of ports that are close to Europe but not inside. For example, Egypt’s East Port Said and Morocco’s Tanger Med. However, ships using transshipment ports less than 300 nm from an EU port will also need to include 50% of emissions to that port as well as the shorter leg from just outside of the EU.

At the end of each year, shipping companies will submit details of their voyages and emissions to the administering authority (member state) with which they are registered. Registration depends on which member state the company has visited the most over the last four years. Or, for newer companies, their first port call. An independent verifier will then review the reports and issue a Document of Compliance for each ship.

For each tonne of carbon dioxide emitted by their ships, companies will need to have purchased allowances that they will submit to the administering authority by September of the next calendar year being reported. This will be phased-in: allowances will reflect 40% of emissions in 2024, 70% in 2025 and 100% from 2026 onwards.

The purchasing of allowances must now be factored into pricing between stakeholders in the value chain and most companies have already announced estimates of the extra charges. These range from Maersk’s 228 euro charge for forty-foot reefer containers between Europe and West Africa and Hapag-Lloyd’s 7 euro charge for a twenty-foot dry container between East Asia and South Europe.[1][2] Shippers already signed up to Hapag-Lloyd’s Ship Green programme or Maersk’s Eco Delivery will receive credit to offset the costs.

Maersk EU ETS surcharge estimates Q1 2024

EU Emissions Trading System (EU ETS) surcharge estimates, in EUR per forty-foot container (FEU)

| Trade Route | Dry fee per FEU (EUR) | Reefer fee per FEU (EUR) |

|---|---|---|

| West Coast South America to Europe | 74 | 111 |

| Europe to West Coast South America | 83 | 125 |

| North Europe to Far East | 46 | 69 |

| Far East to North Europe | 70 | 105 |

| South Europe to Far East | 11 | 17 |

| Far East to South Europe | 20 | 30 |

| North Europe to Middle East & Indian Subcontinent | 32 | 48 |

| Middle East & Indian Subcontinent to North Europe | 25 | 38 |

| Mediterranean to Middle East & Indian Subcontinent | 55 | 83 |

| Middle East & Indian Subcontinent to Mediterranean | 36 | 54 |

| Mediterranean to North Europe | 41 | 62 |

| North Europe to Mediterranean | 41 | 62 |

| Intra Mediterranean | 45 | 68 |

| Intra North Europe | 22 | 33 |

| North America to Mediterranean | 66 | 99 |

| Mediterranean to North America | 91 | 137 |

| Oceania - Europe, Middle east & Africa | 21 | 32 |

| Europe, Middle east & Africa to Oceania | 37 | 56 |

| South Africa to Europe | 66 | 99 |

| Europe to South Africa | 47 | 71 |

| Canada to North Europe | 49 | 74 |

| North Europe to Canada | 81 | 122 |

| USA to North Europe | 58 | 87 |

| North Europe to USA | 81 | 122 |

| West Africa to Europe | 87 | 131 |

| Europe to West Africa | 152 | 228 |

| Europe to East Coast South America | 49 | 74 |

| East Coast South America to Europe | 40 | 60 |

| East Africa to Europe | 36 | 54 |

| Europe to East Africa | 56 | 84 |

| Europe to Indian Ocean Islands | 31 | 47 |

| Indian Ocean Islands to Europe | 16 | 24 |

Hapag-Lloyd EU ETS surcharge estimates for 2024

EU Emissions Trading System (EU ETS) surcharge estimates, in EUR per twenty-foot container (TEU)

| Trade Route | Dry fee per TEU (EUR) | Reefer fee per TEU (EUR) |

|---|---|---|

| East Asia – North Europe | 12 | 31 |

| East Asia – South Europe | 7 | 16 |

| North Europe – North Am East Coast incl. MX East Coast | 9 | 16 |

| North Europe – South America West Coast | 12 | 21 |

| Europe – West Africa | 17 | 29 |

| North Europe – Middle East | 12 | 22 |

CMA-CGM EU ETS surcharge estimates

EU Emissions Trading System (EU ETS) surcharge estimates, in EUR per twenty-foot container (TEU)

| Trade route | Dry fee per TEU (EUR) | Reefer fee per TEU (EUR) |

|---|---|---|

| Asia to North Europe | 25 | 40 |

| Asia to Mediterranean | 20 | 30 |

| Europe to North America | 43 | 65 |

| Europe to South America West Coast | 43 | 60 |

| North Europe to Mediterranean | 25 | 35 |

| Intra Mediterranean | 25 | 40 |

| Intra North Europe | 37 | 48 |

Whilst most companies have calculated the surcharges on top of the contracted rates, companies that operate in and out of China have had to take notice of Shanghai Shipping Exchange regulations that mean charges have to be added to the base freight rate (instead of as an additional surcharge).[3] An exception also applies for Maersk into and out of Djibouti and Ethiopia, where charges will be on a prepaid basis.[4]

The big question is whether these fees will be enough to divert traffic away from Europe. Large volumes of ships stop at Europe on their way to other destinations. Ministers from seven European nations are understood to have already expressed their concern that the measures will in fact increase global emissions, with shippers bypassing Europe and taking longer routes.[5]

The scheme classifies a port of call as one where a ship loads or unloads cargo, embarks or disembarks passengers, or where an offshore ship stops to relieve the crew.[6] Ports in North Africa, Turkey and the Middle East are likely to change their approach to try and attract ships that would have usually gone to locations such as Greece or Italy. A study from the Port of Barcelona expects that African ports will benefit through economic expansions and greater ties with European ports.[7] Another way to avoid the system would be to use ship-to-ship transfers.

Yet, the charges seem largely insignificant when placed alongside the large swings in bunker prices. Between 2020 and 2022, for example, Bunker Index price data shows that Rotterdam recorded a price spread for very-low-sulphur fuel oil (VLSFO) and marine gasoil (MGO) of $864 and $1291 per tonne, respectively (see chart below). Freight rates have also been at record lows.

| Fuel Grade | Low ($) | High ($) | Spread ($) |

|---|---|---|---|

| HSFO 380 | 110 | 736 | 626 |

| VLSFO 0.5% | 150 | 1014 | 864 |

| MGO | 185 | 1476 | 1291 |

Carriers may include the new surcharges but be forced to change their base rate at the same time. At stake is the question of whether carrier costs (of which ETS charges are now a part) have any significant impact on freight rates when there are so many other factors that determine supply and demand. It is difficult to see the ETS charges causing disruptions amongst these broader forces.

The International Maritime Organisation (IMO) has so far failed to implement a global policy, but plans are in place. A GHG pricing mechanism was part of its basket of candidate mid-term GHG reduction measures (in the 2023 GHG Strategy), and it is expected to be approved at MEPC 83 (Spring 2025) and enter into force 16 months after adoption (in 2027). Looking ahead, it will be interesting to see how the EU's ETS works in conjunction with the forthcoming policy.

As regards IMO's candidate measures, The Marshall Islands and the Solomon Islands have pushed for a Universal Mandatory GHG levy. The GHGL would be paid at the same time as the ship’s fuel and its revenues would be used to fund decarbonization in the shipping sector.

The proposed fund and reward system (F&R) by the International Chamber of Shipping (ICS) would charge ships a levy-based flat rate per tonne of CO2 emitted. It would be calculated on a tank-to-wake basis using the existing Fuel Oil Data Collection System (DCS), with contributions going to a fund that would be used to reward CO2 emissions prevented via the use of alternative fuels.

The International Maritime Sustainability Funding and Reward (IMSF&R) system by Argentina et al. proposes a fund and reward system based on the existing CII measure and on DCS. A ship with CO2 emissions above its upper benchmark level (based on rating boundaries set out in the CII Rating Guidelines, as well as its capacity) would pay for its extra emissions, whilst a ship with CO2 emissions below the lower benchmark level would be rewarded for emissions reduced.

The grievances Brazil and China have over the extra costs are tied up with the broader concerns of the BASIC group of large, emerging economies (Brazil, China, India and South Africa) raised at the recent COP28 about Europe’s new EU ETS as the EU is the primary importer of coffee from Brazil and one of the top importers of cattle, wood, cocoa, rubber and soybeans from the country.

Perhaps the murkiest area for non-EU shippers is how the EU ETS will affect charterers. Charterers are usually held responsible for decisions about the movement — and therefore emissions — of the ship. However, it is likely that the charterer will pass on the costs to those that need the goods moved, and how allowances will be transferred is a particularly grey area in the legislation. This could mean different member states adopt different approaches as to deciding where the responsibility lies. Whether or not charterers choose to wait and see what happens to the price of allowances or whether they are active in the new carbon markets is likely to have a lasting impact.

|

Gram Marine delivers first marine lubricants in San Lorenzo

Operation follows recent strategic partnerships with LPC and Servi Río. |

|

|

|

||

|

Halten Bulk orders wind-assisted bulk carriers with rotor sails from Chinese yard

Norwegian operator contracts two vessels with options for two more at SOHO Marine. |

|

|

|

||

|

IBIA introduces enhanced KYC framework for membership applications

Trade association to use Baltic Exchange platform for sanctions screening and company verification. |

|

|

|

||

|

Servi Río joins Gram Marine and Cyclon alliance for Argentina lube operations

Argentine company to provide storage and transportation services for lubricant products in local market. |

|

|

|

||

|

IMO seminar examines biofuels’ role in maritime decarbonisation

Event drew 700 in-person and virtual participants, with 1,300 more following the online broadcast. |

|

|

|

||

|

Hapag-Lloyd to acquire ZIM for $4.2bn in cash deal

German container line signs agreement to buy Israeli rival, subject to regulatory approvals. |

|

|

|

||

|

VPS outlines key features of Maress 2.0 with enhanced analytics for offshore vessel efficiency

Updated platform adds data validation, energy flow diagrams and fleet comparison tools for decarbonisation monitoring. |

|

|

|

||

|

IMO committee agrees NOx certification rules for ammonia and hydrogen engines

DNV reports PPR 13 also advanced a biofouling framework and crude oil tanker emission controls. |

|

|

|

||

|

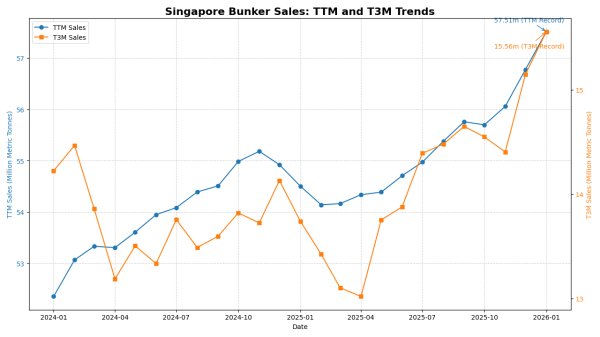

Singapore bunker sales set new record as TTM volumes surpass 57.5 tonnes

Rolling 12-month bunker sales at the Port of Singapore have reached a fresh all-time high, breaking above 57.5 million tonnes for the first time, alongside a record surge in short-term demand. |

|

|

|

||

|

PIL’s LNG-powered Kota Odyssey makes maiden call at Saudi Arabian port

Container vessel marks first entry into the Red Sea with call at Red Sea Gateway Terminal. |

|

|

|

||

| Formula for change: UECC solution for EU ETS gives clients clarity on emission costs | UECC [News & Insights] |

| EU ups renewable energy requirements for 2030 [News & Insights] |

| Four cornerstones for a regulatory environment for sustainable fuels [News & Insights] |