Hapag-Lloyd reports that its average bunker price fell year-on-year (YoY) by $78, or 11.1 percent, to $625 per tonne during the first half (H1) of 2023.

Bunker consumption in H1 for the German shipping line totalled 1.98m tonnes, which was down 6.6% on the 2.12m tonnes recorded a year earlier. The decrease was said to be due to lower transport volumes, the clearing of congestion in front of ports and lower vessel sailing speeds.

As a result, bunker expenses declined by EUR 225.5m, or 16.5 percent, to EUR 1,141.9m in H1 2023, down from EUR 1,367.4m in the prior-year period.

Hapag-Lloyd: Average Bunker Price (US$/mt), 2019-23| Year | H1 | Q2 |

| 2023 | 625.00 | 603.00 |

| 2022 | 703.00 | 793.00 |

| 2021 | 421.00 | 458.00 |

| 2020 | 448.00 | 360.00 |

| 2019 | 429.00 | 434.00 |

| Year | H1 | Q2 |

| 2023 | 1,141.9 | 519.5 |

| 2022 | 1,367.4 | 786.0 |

| 2021 | 725.3 | 403.5 |

| 2020 | 862.9 | 268.6 |

| 2019 | 822.2 | 427.6 |

| Year | H1 | Q2 |

| 2023 | 1.98 | 0.95 |

| 2022 | 2.12 | 1.06 |

| 2021 | 2.11 | 1.06 |

| 2020 | 2.05 | 0.95 |

| 2019 | 2.20 | 1.10 |

Bunker consumption

Bunker consumption per slot (measured by average container slot capacity, annualised) dipped 10% in H1 to 2.18 tonnes. The improvement was due to efficiency measures and lower bunker consumption, Hapag explained.

Bunker consumption per TEU transported also decreased in H1 — by 3% to 0.34 tonnes.

As regards the consumption of low-sulphur bunker (MFO 0.1% and 0.5%, and distillates) and LNG, Hapag said the H1 figure dipped YoY from 88% to 83% due to the fitting of more vessels with scrubbers.

Key financial results

In its overall results, Hapag-Lloyd posted a H1 profit of $3,133m (down 66.9% on the $9,466m result recorded in H1 2022) and a Q2 profit of $1,102 (77% below last year's figure of $4,782m).

EBITDA of $3,775m in H1 represents a 65.5% drop compared to the previous year's $10,942m result. Second-quarter EBITDA decreased YoY by $4,239m, or 75.2 %, to $1,396m.

Revenue in H1 fell 42% YoY from $18,562m to $10,847m, whilst in Q2 the figure dropped 49.8% from $9,606m to $4,819m.

Transport expenses in H1 were 9.3% below the prior-year level, at $6,330m. This was said to be primarily due a lower bunker consumption price of $625 per tonne and lower demurrage and detention expenses.

|

TFG Marine calls for digital transformation to manage alternative fuel risks

CFO says transparency and digital solutions are essential as the marine fuels sector faces volatility from diversification. |

|

|

|

||

|

Reganosa’s Mugardos terminal adds bio-LNG bunkering for ships and trucks

Spanish facility obtains EU sustainability certification to supply renewable fuel with 92% lower emissions. |

|

|

|

||

|

Growth Energy joins Global Ethanol Association as new member

US biofuel trade association represents nearly 100 biorefineries and over half of US ethanol production. |

|

|

|

||

|

H2SITE explains decision to establish Bergen subsidiary

Ammonia-to-hydrogen technology firm says Norwegian city was obvious choice for its ambitions. |

|

|

|

||

|

Gibraltar Port Authority issues severe weather warning for gale-force winds and heavy rain

Port authority warns of storm-force gusts of up to 50 knots and rainfall totals reaching 120 mm. |

|

|

|

||

|

Christiania Energy relocates headquarters within Odense Harbour

Bunker firm moves to larger waterfront office to accommodate growing team and collaboration needs. |

|

|

|

||

|

HD Hyundai Heavy Industries receives design approval for 20,000-cbm LNG bunkering vessel

Bureau Veritas grants approval in principle following joint development project with South Korean shipbuilder. |

|

|

|

||

|

Peninsula outlines dual role in FuelEU Maritime compliance at Lloyd’s Register panel

Marine fuel supplier discusses challenges for shipowners and opportunities for suppliers under new regulation. |

|

|

|

||

|

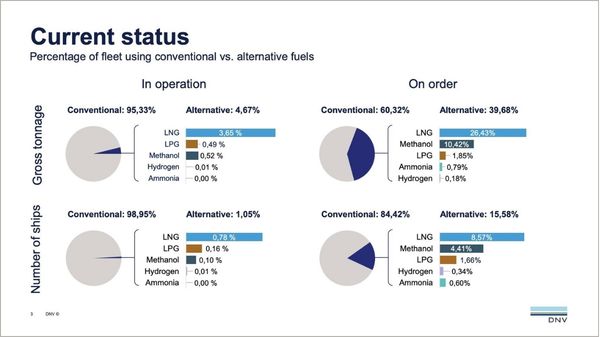

LNG-fuelled container ships dominate January alternative-fuel vessel orders

Container ships accounted for 16 of 20 alternative-fuelled vessels ordered in January, DNV reports. |

|

|

|

||

|

GCMD and CIMAC sign partnership to advance alternative marine fuel readiness

Two-year agreement aims to bridge operational experience with technical standards for decarbonisation solutions. |

|

|

|

||

| ExxonMobil starts Hapag ARA biofuel deliveries [News & Insights] |