|

Anglo-Eastern completes pilot training course for ammonia-fuelled vessels

Ship manager prepares crew ahead of first ammonia-fuelled vessel takeover with inaugural training programme. |

|

|

|

||

|

Burando Atlantic publishes first sustainability report, secures ISCC EU recertification

Maritime group releases inaugural sustainability report while Burando Energies extends biofuel traceability certification. |

|

|

|

||

|

ABB and HDF Energy to develop high-power fuel cells for large ships

Joint development targets megawatt-scale hydrogen fuel cell units for container feeders and liquefied hydrogen carriers. |

|

|

|

||

|

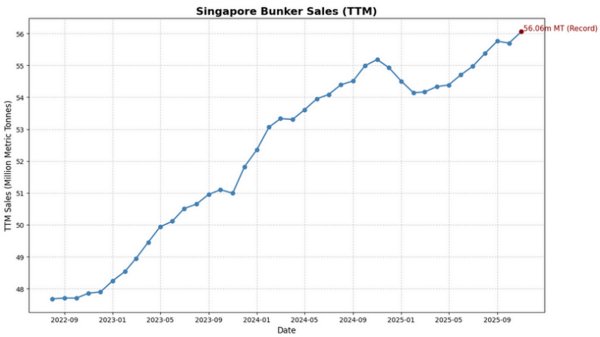

Singapore bunker sales break new ground as TTM volumes surpass 56m tonnes

Trailing 12-month bunker sales rise to new all-time record at Asian port. |

|

|

|

||

|

Odfjell launches operational green corridor between Brazil and Europe using biofuel

Chemical tanker operator establishes route using B24 sustainable biofuel without subsidies or government support. |

|

|

|

||

|

Somtrans christens 8,000-cbm LNG bunker barge for Belgian and Dutch ports

United LNG I designed for inland waterways and coastal operations up to Zeebrugge. |

|

|

|

||

|

BIMCO adopts FuelEU Maritime and ETS clauses for ship sales, advances biofuel charter work

Documentary Committee approves regulatory clauses for vessel transactions, progresses work on decarbonisation and emerging cargo contracts. |

|

|

|

||

|

Four companies launch study for US methanol bunkering network

ABS, Eneos, NYK Line, and Seacor to develop ship-to-ship methanol supply operations on Gulf Coast. |

|

|

|

||

|

CMA CGM names dual-fuel methanol vessel for Phoenician Express service

CMA CGM Antigone to operate on BEX2 route connecting Asia, the Middle East and Mediterranean. |

|

|

|

||

|

Golden Island appoints Capt Kevin Wong as chief operating officer

Wong to oversee ship management and low-carbon fuel development at Singapore-based marine fuels company. |

|

|

|

||

| Andatee committee appoints advisors [News & Insights] |

| Another US law firm to investigate Andatee [News & Insights] |

| Law firms investigate Andatee buyout proposal [News & Insights] |

| Andatee CEO in bid to buy remaining shares [News & Insights] |