Mitsui O.S.K. Lines (MOL) reports that net income jumped JPY 620.955bn ($4.849bn) to JPY 714.154bn ($5.578bn) during the fiscal year ending March 31. This was despite a 64.8 percent year-on-year (YoY) increase in the average bunker price.

The mean price of all major fuel grades purchased increased by $230 to $585 per tonne between April 2021 and March 2022.

MOL noted that its ferry and coastal ro-ro business saw a YoY deterioration in profit, reflecting rising bunker prices.

In its outlook for the current financial year, MOL predicts an average price of $650 per tonne for high-sulphur fuel oil (HSFO) and $810 per tonne for very-low-sulphur fuel oil (VLSFO).

| Period | 2021-22 | 2020-21 |

| Apr-Jun | 497 | 255 |

| Apr-Sep | 514 | 296 |

| Apr-Dec | 539 | 315 |

| Apr-Mar | 585 | 355 |

Key financial results and developments

In its key financials for 2021-22, MOL's revenue climbed JPY 277.884bn ($2.17bn), or 28.0 percent, to JPY 1,269.310bn ($9.913bn) as net income reached JPY 714.154bn ($5.578bn); and the Japanese shipper swung into the black with an operating profit of JPY 55.005bn ($429.6m), compared with the previous year's loss of JPY 5.303bn ($41.4m).

As regards the balance sheet, assets as at March 31 were JPY 2,686.701bn ($20.983bn), liabilities stood at JPY 1,351.835bn ($10.558bn) and equity at JPY 1,334.866bn ($10.425bn).

MOL said its LNG carrier division generated stable profit mainly through existing long-term charter contracts in addition to profit from the delivery of a new LNG carrier and an LNG bunkering vessel posting a year-on-year rise in profit.

Forecast for 2022-23

For the fiscal year ending March 31, 2023, MOL forecasts shareholder profit will fall by JPY 208.819bn ($1.63bn), or 29.5 percent, to JPY 500bn ($3.91bn), whilst operating profit is estimated at JPY 46bn ($359.3m) — a YoY decline of JPY 9.005bn ($70.3m), or 16.4 percent.

Revenue, meanwhile, is predicted to climb JPY 83.69bn ($653.6m), or 6.6 percent, to JPY 1,353bn ($10.567bn).

Commenting on the year ahead, MOL said: "In the fiscal year ending March 2023, there is a risk that our company's businesses will be affected by factors such as the risk of an economic downturn caused by increasing global inflation and fluctuations in transportation demand resulting from the Russia-Ukraine situation. In the dry bulk carrier and energy transportation business, our company is mainly engaged in medium- to long-term contracts. Therefore, fluctuations in the business cycle and transportation demand are expected to have a relatively small impact on business performance.

"However, fluctuations in market conditions and cargo movements are expected to have a certain impact on our business performance for some short-term contracts. In the product transportation business including containerships, although the direct impact on cargo movement from the situation in Russia and Ukraine is limited, we anticipate that there will be a phase in which transportation demand will weaken due to the slowdown of the world economy or the impact on parts procurement and logistics."

|

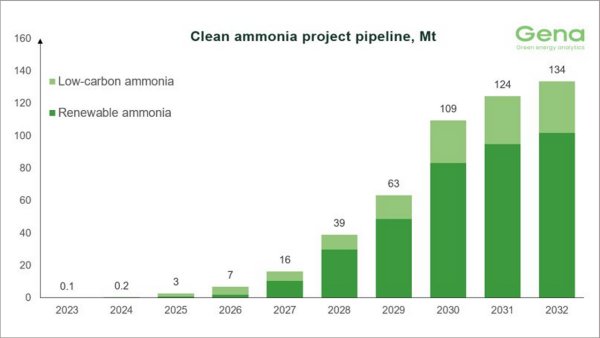

Clean ammonia project pipeline reaches 145 MMT by 2034, but delivery concerns mount

GENA Solutions reports 325 tracked projects, though over 70 have been frozen in 20 months. |

|

|

|

||

|

Peninsula highlights supply chain strength amid Strait of Hormuz closure

Marine fuel seller emphasises reliability as geopolitical disruption reshapes global bunker markets. |

|

|

|

||

|

World Shipping Council backs EU maritime strategies but calls for faster trade simplification

Industry body supports port security and decarbonisation measures while urging action on customs barriers. |

|

|

|

||

|

Anemoi and Lloyd’s Register call for unified approach to wind propulsion performance verification

Anemoi Marine Technologies and Lloyd’s Register publish paper advocating alignment of verification methodologies. |

|

|

|

||

|

Smyril Line's methanol-ready ro-ro launched in China

First of two 3,300 lane-metre vessels floated out for Faroese operator. |

|

|

|

||

|

ICS webinar explores regulatory framework for nuclear-powered merchant ships

Industry experts discuss the timeline and challenges for adopting nuclear propulsion in the commercial shipping sector. |

|

|

|

||

|

Oilmar DMCC seeks senior bunker trader for Dubai office

Dubai-based energy trader recruiting for Middle East, Indian subcontinent and Africa trade flows. |

|

|

|

||

|

Oilmar DMCC seeks bunker traders for Singapore office

Dubai-based trader recruiting mid-level and senior professionals to expand Asia-Pacific marine fuels operations. |

|

|

|

||

|

ClassNK updates EU shipping emissions guidance for LNG-fuelled vessels

Japanese classification society releases revised FAQs addressing methane slip measurement procedures. |

|

|

|

||

|

Bureau Veritas delivers first 15,000-teu methanol dual-fuel container ship for CMA CGM

Classification society completes delivery of CMA CGM Monte Cristo built by DSIC Tianjin. |

|

|

|

||

| Total launches huge-capacity LNG bunker vessel [News & Insights] |

| Hapag sees $270m rise in bunker costs [News & Insights] |

| Norden's bunker costs up $101m in 2021 [News & Insights] |

| Maersk spent $1.5bn more on bunkers in 2021 [News & Insights] |