|

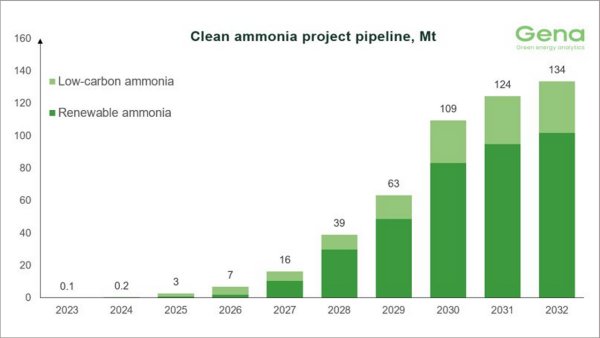

Clean ammonia project pipeline reaches 145 MMT by 2034, but delivery concerns mount

GENA Solutions reports 325 tracked projects, though over 70 have been frozen in 20 months. |

|

|

|

||

|

Peninsula highlights supply chain strength amid Strait of Hormuz closure

Marine fuel seller emphasises reliability as geopolitical disruption reshapes global bunker markets. |

|

|

|

||

|

World Shipping Council backs EU maritime strategies but calls for faster trade simplification

Industry body supports port security and decarbonisation measures while urging action on customs barriers. |

|

|

|

||

|

Anemoi and Lloyd’s Register call for unified approach to wind propulsion performance verification

Anemoi Marine Technologies and Lloyd’s Register publish paper advocating alignment of verification methodologies. |

|

|

|

||

|

Smyril Line's methanol-ready ro-ro launched in China

First of two 3,300 lane-metre vessels floated out for Faroese operator. |

|

|

|

||

|

ICS webinar explores regulatory framework for nuclear-powered merchant ships

Industry experts discuss the timeline and challenges for adopting nuclear propulsion in the commercial shipping sector. |

|

|

|

||

|

Oilmar DMCC seeks senior bunker trader for Dubai office

Dubai-based energy trader recruiting for Middle East, Indian subcontinent and Africa trade flows. |

|

|

|

||

|

Oilmar DMCC seeks bunker traders for Singapore office

Dubai-based trader recruiting mid-level and senior professionals to expand Asia-Pacific marine fuels operations. |

|

|

|

||

|

ClassNK updates EU shipping emissions guidance for LNG-fuelled vessels

Japanese classification society releases revised FAQs addressing methane slip measurement procedures. |

|

|

|

||

|

Bureau Veritas delivers first 15,000-teu methanol dual-fuel container ship for CMA CGM

Classification society completes delivery of CMA CGM Monte Cristo built by DSIC Tianjin. |

|

|

|

||

| Higher bunker prices drive up voyage costs as Eagle Bulk posts 2017 loss [News & Insights] |