|

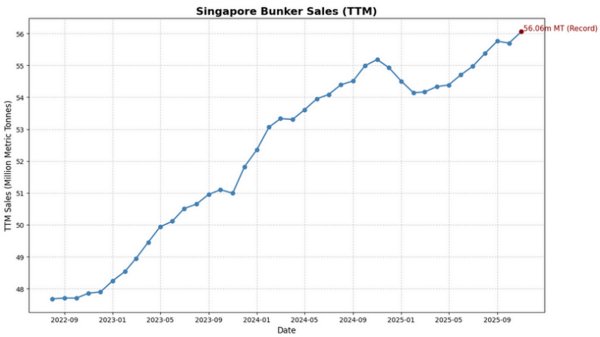

Singapore bunker sales break new ground as TTM volumes surpass 56m tonnes

Trailing 12-month bunker sales rise to new all-time record at Asian port. |

|

|

|

||

|

Odfjell launches operational green corridor between Brazil and Europe using biofuel

Chemical tanker operator establishes route using B24 sustainable biofuel without subsidies or government support. |

|

|

|

||

|

Somtrans christens 8,000-cbm LNG bunker barge for Belgian and Dutch ports

United LNG I designed for inland waterways and coastal operations up to Zeebrugge. |

|

|

|

||

|

BIMCO adopts FuelEU Maritime and ETS clauses for ship sales, advances biofuel charter work

Documentary Committee approves regulatory clauses for vessel transactions, progresses work on decarbonisation and emerging cargo contracts. |

|

|

|

||

|

Four companies launch study for US methanol bunkering network

ABS, Eneos, NYK Line, and Seacor to develop ship-to-ship methanol supply operations on Gulf Coast. |

|

|

|

||

|

CMA CGM names dual-fuel methanol vessel for Phoenician Express service

CMA CGM Antigone to operate on BEX2 route connecting Asia, the Middle East and Mediterranean. |

|

|

|

||

|

Golden Island appoints Capt Kevin Wong as chief operating officer

Wong to oversee ship management and low-carbon fuel development at Singapore-based marine fuels company. |

|

|

|

||

|

LPC launches Argentine marine lubricants hub with Gram Marine

Motor Oil Hellas subsidiary partners with maritime services provider to supply products to regional ports. |

|

|

|

||

|

Hapag-Lloyd orders eight methanol-powered container ships worth over $500m

German carrier signs deal with CIMC Raffles for 4,500-teu vessels for 2028-29 delivery. |

|

|

|

||

|

Vale joins Global Ethanol Association as founding member

Brazilian mining company becomes founding member of association focused on ethanol use in maritime sector. |

|

|

|

||

| Saudi Aramco sells new fuel oil cargoes [News & Insights] |

| FAL buys 90,000-tonne fuel oil cargo [News & Insights] |

| IOC sells mid-August 380-cst cargo [News & Insights] |

| Nippon Oil buys stake in lubes firm [News & Insights] |