Singapore Petroleum lands 380-cst cargo - sources

Bunker supplier is reported to have paid a premium to Singapore spot quotes.

Saudi Arabian refiner Saudi Aramco has sold a cargo of 380-centistoke (cst) fuel oil for early-August delivery, according to market sources.

The 80,000-tonne parcel is reported to be destined for Singapore, with local supplier Singapore Petroleum Corp paying a premium of $3-4 per tonne to Singapore spot quotes, on a free-on-board basis, traders said.

The A962 cargo is said to be scheduled for loading on August 9th from the Red Sea port of Rabigh.

Aramco's deal price with Singapore Petroleum reflects strengthening market fundamentals and the expectation that fuel oil supplies will remain tight for the rest of the year on reduced refinery runs, a spillover from a firm Middle East market, and steady demand from the Asian marine fuels sector, the product's largest outlet.

India, for example - a major exporter of fuel oil - has seen exports fall in recent weeks, largely due to production cuts at local refineries. This is despite the fact that during the monsoon season domestic consumption and asphalt demand falls, usually prompting a rise rather than a decline in exports.

Last week, Aramco sold a 380-cst parcel for August 9 loading from Jubail to an unnamed party at near parity to Singapore spot quotes, FOB.

The price negotiated was higher than the $4.50 per tonne to Singapore spot quotes, FOB, negotiated with Shell for a Jubail cargo due to be loaded on July 27.

Aramco previously sold a cargo of A962 for July 20-21 loading to oil major Total at a discount of between $1-$2 per tonne to Singapore spot quotes, FOB.

This compares with a discount of around $6.00 per tonne to Singapore spot quotes, FOB, Japan's Itochu paid for an A962 cargo loading from Rabigh on April 19-21.

The 80,000-tonne parcel is reported to be destined for Singapore, with local supplier Singapore Petroleum Corp paying a premium of $3-4 per tonne to Singapore spot quotes, on a free-on-board basis, traders said.

The A962 cargo is said to be scheduled for loading on August 9th from the Red Sea port of Rabigh.

Aramco's deal price with Singapore Petroleum reflects strengthening market fundamentals and the expectation that fuel oil supplies will remain tight for the rest of the year on reduced refinery runs, a spillover from a firm Middle East market, and steady demand from the Asian marine fuels sector, the product's largest outlet.

India, for example - a major exporter of fuel oil - has seen exports fall in recent weeks, largely due to production cuts at local refineries. This is despite the fact that during the monsoon season domestic consumption and asphalt demand falls, usually prompting a rise rather than a decline in exports.

Last week, Aramco sold a 380-cst parcel for August 9 loading from Jubail to an unnamed party at near parity to Singapore spot quotes, FOB.

The price negotiated was higher than the $4.50 per tonne to Singapore spot quotes, FOB, negotiated with Shell for a Jubail cargo due to be loaded on July 27.

Aramco previously sold a cargo of A962 for July 20-21 loading to oil major Total at a discount of between $1-$2 per tonne to Singapore spot quotes, FOB.

This compares with a discount of around $6.00 per tonne to Singapore spot quotes, FOB, Japan's Itochu paid for an A962 cargo loading from Rabigh on April 19-21.

|

Methanol as a marine fuel | Steve Bee, VPS

How environmental legislation has driven the development of low-sulphur fuels and methanol-ready ships. |

|

|

|

||

|

Martin Vorgod elevated to CEO of Global Risk Management

Vorgod, currently CCO at GRM, will officially step in as CEO on December 1, succeeding Peder Møller. |

|

|

|

||

|

Dorthe Bendtsen named interim CEO of KPI OceanConnect

Officer with background in operations and governance to steer firm through transition as it searches for permanent leadership. |

|

|

|

||

|

Bunker Holding revamps commercial department and management team

CCO departs; commercial activities divided into sales and operations. |

|

|

|

||

|

Peninsula extends UAE coverage into Abu Dhabi and Jebel Ali

Supplier to provide 'full range of products' after securing bunker licences. |

|

|

|

||

|

Peninsula to receive first of four tankers in Q2 2025

Methanol-ready vessels form part of bunker supplier's fleet renewal programme. |

|

|

|

||

|

Stephen Robinson heads up bunker desk at Tankers International

Former Bomin and Cockett MD appointed Head of Bunker Strategy and Procurement. |

|

|

|

||

|

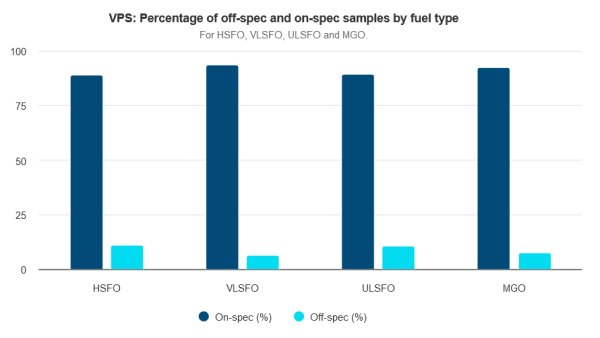

Is your vessel fully protected from the dangers of poor-quality fuel? | Steve Bee, VPS

Commercial Director highlights issues linked to purchasing fuel and testing quality against old marine fuel standards. |

|

|

|

||

|

GDE Marine targets Suape LSMGO by year-end

Expansion plan revealed following '100% incident-free' first month of VLSFO deliveries. |

|

|

|

||

|

Peninsula CEO seals deal to build LNG bunker vessel

Agreement signed through shipping company Hercules Tanker Management. |

|

|

|

||

Related Links

- · Saudi Aramco sells new fuel oil cargoes [Insights]

- · FAL buys 90,000-tonne fuel oil cargo [Insights]

- · IOC sells mid-August 380-cst cargo [Insights]

- · Nippon Oil buys stake in lubes firm [Insights]

- · Singapore [Directory]

- · Saudi Arabia [Directory]

- · Singapore [Directory]