|

Varo Energy has announced an agreement to acquire Preem Holding AB and Preem AB in an all-cash transaction as part of a strategic move aimed at bolstering its position in the renewable fuel sector. The acquisition involves the purchase of 100% of the share capital of Preem's parent company, Corral Petroleum Holdings AB, and is expected to close in the second half of 2025, pending regulatory approvals.

The decision to pursue this acquisition follows a competitive merger and acquisition process initiated after Corral Petroleum Holdings revealed a strategic review of its assets in late 2023. Varo has been engaged in the discussions for over 15 months, having entered exclusivity in August 2024. Deutsche Bank (Suisse) SA acted on behalf of Corral Petroleum Holdings to execute the sale agreement.

As a bunker supplier, Preem carries out deliveries along Sweden's west coast (in Gothenburg, Halmstad, Lysekil, Uddevalla and Malmö) and east coast (in Stockholm, Gävle, Norrköping and Sundsvall), in the southwest port of Malmö and in the southeast ports of Kalmar and Karlshamn.

With a total refining capacity of around 352,000 barrels per day at its plants in Gothenburg and Lysekil, Preem is Sweden's largest refiner. It is also one of the largest energy providers in Scandinavia, supplying over 40% of Sweden's and around a quarter of the region's energy requirements for transportation.

Preem currently produces 0.3 million tonnes per annum (mtpa) of renewable fuel, which is set to increase to 1.3 mtpa following upgrades to its Synsat diesel plant that will enable co-processing of renewable feedstocks. Since 2010, the firm has invested nearly $1bn since 2010 in the production of renewable fuels and initiatives aimed at reducing the carbon intensity throughout the value chain.

Dev Sanyal, CEO of Varo, noted: "The acquisition of Preem is transformational for Varo. On completion, we will become Europe's second largest renewable fuel producer, with an extensive distribution and storage network across major European markets."

The combined entity will manage conventional fuel production capacity of 530,000 barrels per day.

The integration of Preem's operations will also make Varo the largest co-processor of renewable feedstocks in Europe and among the top five producers of hydrotreated vegetable oil (HVO) globally.

The anticipated increase in biofuel demand, driven by decarbonisation efforts within the EU and in shipping, further underscores the strategic relevance of this acquisition.

|

DNV to host webinar on FuelEU Maritime compliance strategies

Classification society offers insights as first reporting period closes and verification phase begins. |

|

|

|

||

|

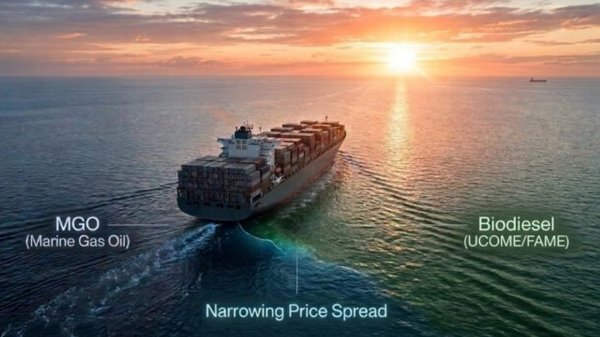

Biodiesel–MGO price spread narrows to $400–500/mt in Northwest Europe

Bunker One says tighter spread creates opportunities for shipping companies pursuing decarbonisation targets. |

|

|

|

||

|

Exmar to discuss ammonia-fuelled vessel operations in webinar

Shipowner will explore safety measures and partnerships for new dual-fuel ammonia carriers. |

|

|

|

||

|

Skuld reports engine damage from CNSL biofuel blends amid rising alternative fuel adoption

Marine insurer details operational challenges with biofuels, including FAME, CNSL and UCOME across member vessels. |

|

|

|

||

|

GRM and Bunker Holding to host webinar on Middle East war's impact on energy markets

Webinar on 9 March will examine effects on crude oil, bunker and gas markets. |

|

|

|

||

|

Clean ammonia project pipeline reaches 145 MMT by 2034, but delivery concerns mount

GENA Solutions reports 325 tracked projects, though over 70 have been frozen in 20 months. |

|

|

|

||

|

Peninsula highlights supply chain strength amid Strait of Hormuz closure

Marine fuel seller emphasises reliability as geopolitical disruption reshapes global bunker markets. |

|

|

|

||

|

World Shipping Council backs EU maritime strategies but calls for faster trade simplification

Industry body supports port security and decarbonisation measures while urging action on customs barriers. |

|

|

|

||

|

Anemoi and Lloyd’s Register call for unified approach to wind propulsion performance verification

Anemoi Marine Technologies and Lloyd’s Register publish paper advocating alignment of verification methodologies. |

|

|

|

||

|

Smyril Line's methanol-ready ro-ro launched in China

First of two 3,300 lane-metre vessels floated out for Faroese operator. |

|

|

|

||

| Swedish government bans scrubber wastewater discharges [News & Insights] |