From greenwashing to 'wacky' bunker margins

Interview with Adrian Beciri, CEO of Ducat Maritime.

|

We spoke to Adrian Beciri, CEO of the logistics provider Ducat Maritime, based in Limassol, Cyprus. Ducat focuses on West Africa, covering dry bulk and bagged goods, and predominantly buys very-low-sulphur fuel oil (VLSFO) and some low-sulphur marine gasoil (LSMGO), mainly from Singapore, Colombo and Trincomalee. The company operates break bulk shipping routes combined with in-port logistics solutions, and fuel is occasionally also purchased in South Africa and Fujairah as well as small parcels up and down the west coast of Africa.

As one of the largest transporters of rice to West Africa, when it comes to bunker-related issues, Beciri explains that “often the price of fuel is secondary to the actual logistics, in some locations”. For example, with offshore bunker delivery vessels moving up and down the coast of West Africa, and misrepresentations of where the tanker is located, actually getting to it “might cost you upwards of $30,000, $40,000” — double that during Covid.

But perhaps more difficult to navigate is the “general lack of accountability” in shipping, according to Beciri, who reflects that “lots of people are trying to pass the buck and cover up evidence. That's just a characteristic of the industry”.

As an example, Beciri notes that some bunker suppliers “lowball the volume of fuel ... and you’re never sure if a deal has been done on the side”. And in disputes when the fuel is said to not meet ISO 2017 specifications, for example, “it is difficult to bring any damages against a supplier ... because the terms of trade on bunkers are very rigid”.

Beciri adds that even sellers with a good reputation “tend to step away from the process and let you handle it”. Poor quality fuel damages engines, but when it comes to bunker claims “it’s about establishing causality, because you don’t know if that’s pre-existing damage. ... Discovery is actually quite hard in the shipping industry”. And with piracy, and the “wacky margins” involved in the premium for fuel in West Africa, there tends to be a general lack of fluidity, he contends.

The maritime industry has, for some time, been calling for the more widespread use of mass flow meters, and as seen at a recent China Petroleum Circulation Association (CPCA) meeting held on January 9, pressure is helping to build innovation and alliances. Ducat already runs quantity surveys, but Beciri would like to see the implementation of “a standard flow meter, regulated by an international body ... because a lot of these discrepancies are caused by owners misdeclaring intentionally the amount of fuel that they consume”. This is where industry experience becomes extremely valuable. Beciri explains that Ducat have operators with seven or eight years’ experience in handling these types of incidents.

As the firm operates predominantly between Asia and Africa, the effects of the new European Union greenhouse gas (GHG) emissions trading scheme (EU ETS) have so far not been felt. But with the IMO currently also debating different plans to cut GHGs on a global level, Beciri is adamant that “having seen these things over the past decades ... there will need to be buy-in from industry”.

“Everyone can see the benefits to the environment,” he says, but changes will need to be made “with a lot of feedback from commercial entities so that people understand that there are consequences and damages to the commercial world from doing this”.

Staying ahead of the market and being “nimble” is Beciri’s strategy ahead of regulatory changes around emissions, drawing on the experience of having to switch from high-sulphur fuel oil (HSFO) to VLSFO as stricter IMO regulations came into effect in 2020 — when the firm “had to hedge ... and pre-book a whole load of bunkers in advance”.

Ducat has so far not seen sweeping changes with the Energy Efficiency Existing Ship Index (EEXI) regulations. Despite reports citing a rise in newbuild orders capable of running on alternative fuels, Beciri thinks the market “is not really responding” and stakeholders “do not want to commit to a 30-year asset” because “they don’t know what the regulatory landscape is going to look like”.

Ducat's CEO sympathizes with the regulators, acknowledging that there will be very different scientific opinions, but he also sees “a lot of indecision”. He thinks the bigger shipping companies "are involved in greenwashing by investing in an experimental model and burning XYZ fuel, [when] we don't really know what the outcome will be”.

As regards the pooling of ships on an environmental basis, Beciri believes it will function in the same way that commercial pooling currently works and that there will be advantages to having a polluting or environmental ship in the pool.

Ultimately, he suspects “there’ll be some kind of pollution tax ... and there’ll need to be a regulatory agency that does that”, with feedback from commercial entities. Ducat’s responsibilities as a large transporter will continue to be that they “need to make sure they get the pricing right, passing the risk appropriately”.

“A quick environmental win” that seems to be working, in Beciri's view, is that ships are now generally running a lot slower, at eco-speeds. He posits that this has not caused an increase in prices as the extra time cost is being matched by reductions elsewhere.

Beciri adds that an alternative, preferred green fuel is much more likely to be “a high-density chemical liquid that releases energy” — as the higher the energy density of a fuel, the less space is needed for fuel storage, and more space is then available for regular cargo.

|

Methanol as a marine fuel | Steve Bee, VPS

How environmental legislation has driven the development of low-sulphur fuels and methanol-ready ships. |

|

|

|

||

|

Martin Vorgod elevated to CEO of Global Risk Management

Vorgod, currently CCO at GRM, will officially step in as CEO on December 1, succeeding Peder Møller. |

|

|

|

||

|

Dorthe Bendtsen named interim CEO of KPI OceanConnect

Officer with background in operations and governance to steer firm through transition as it searches for permanent leadership. |

|

|

|

||

|

Bunker Holding revamps commercial department and management team

CCO departs; commercial activities divided into sales and operations. |

|

|

|

||

|

Peninsula extends UAE coverage into Abu Dhabi and Jebel Ali

Supplier to provide 'full range of products' after securing bunker licences. |

|

|

|

||

|

Peninsula to receive first of four tankers in Q2 2025

Methanol-ready vessels form part of bunker supplier's fleet renewal programme. |

|

|

|

||

|

Stephen Robinson heads up bunker desk at Tankers International

Former Bomin and Cockett MD appointed Head of Bunker Strategy and Procurement. |

|

|

|

||

|

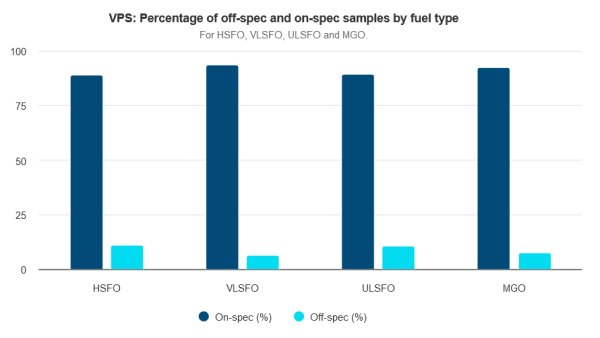

Is your vessel fully protected from the dangers of poor-quality fuel? | Steve Bee, VPS

Commercial Director highlights issues linked to purchasing fuel and testing quality against old marine fuel standards. |

|

|

|

||

|

GDE Marine targets Suape LSMGO by year-end

Expansion plan revealed following '100% incident-free' first month of VLSFO deliveries. |

|

|

|

||

|

Peninsula CEO seals deal to build LNG bunker vessel

Agreement signed through shipping company Hercules Tanker Management. |

|

|

|

||