|

UK's first commercial biomethanol bunkering service launches at Immingham

Exolum, Methanex and Ørsted partner to supply biomethanol for shipping at the UK's largest port by tonnage. |

|

|

|

||

|

Vitol Bunkers launches HSFO supply in Pakistan after four-year hiatus

Company resumes high-sulphur fuel oil bunkering at three Pakistani ports following earlier VLSFO and LSMGO launches. |

|

|

|

||

|

CIMC SOE secures orders for three LNG bunkering vessels

Chinese shipbuilder adds two 20,000 cbm and one 18,900 cbm LNG bunkering vessels to order book. |

|

|

|

||

|

Lehmann Marine to supply battery systems for Hamburg’s first electric ferries

German firm wins contract for three 3.8 MWh systems for HADAG vessels entering service in 2028. |

|

|

|

||

|

Viking Line green corridor project marks two years with biogas use and shore power progress

Turku-Stockholm route partnership reports tenfold increase in renewable biogas use and advancing electrification infrastructure. |

|

|

|

||

|

Global Fuel Supply unveils Blue Alliance tanker after Dubai upgrade works

Marine fuel supplier completes intermediate survey and technical upgrades on vessel ahead of operational service. |

|

|

|

||

|

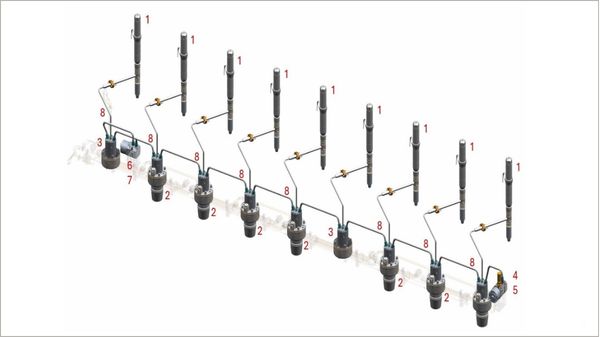

Everllence common-rail technology surpasses 20 million operating hours

Engine maker’s common-rail systems reach milestone across 600 engines and 5,500 cylinders over 18 years. |

|

|

|

||

|

LR Advisory appointed by Geogas Trading to develop FuelEU Maritime compliance strategy

Lloyd’s Register division to support charterer with emissions planning and FuelEU pooling operationalisation. |

|

|

|

||

|

ICS survey shows maritime leaders favour LNG as industry awaits IMO net-zero vote

Barometer reveals strategic shift towards conservative fuel choices amid regulatory uncertainty over decarbonisation framework. |

|

|

|

||

|

Petrobras bunker operations to close for Carnival, with higher prices during holiday period

Brazilian headquarters shut 16-18 February; Rotterdam office to handle new sales during closure. |

|

|

|

||

| Oil and fuel oil hedging market update [News & Insights] |