|

Hapag-Lloyd to acquire ZIM for $4.2bn in cash deal

German container line signs agreement to buy Israeli rival, subject to regulatory approvals. |

|

|

|

||

|

VPS outlines key features of Maress 2.0 with enhanced analytics for offshore vessel efficiency

Updated platform adds data validation, energy flow diagrams and fleet comparison tools for decarbonisation monitoring. |

|

|

|

||

|

IMO committee agrees NOx certification rules for ammonia and hydrogen engines

DNV reports PPR 13 also advanced a biofouling framework and crude oil tanker emission controls. |

|

|

|

||

|

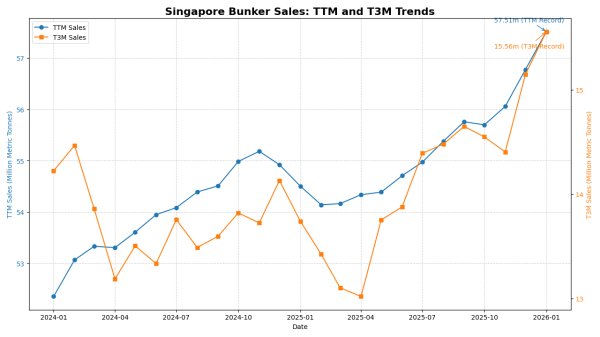

Singapore bunker sales set new record as TTM volumes surpass 57.5 tonnes

Rolling 12-month bunker sales at the Port of Singapore have reached a fresh all-time high, breaking above 57.5 million tonnes for the first time, alongside a record surge in short-term demand. |

|

|

|

||

|

PIL’s LNG-powered Kota Odyssey makes maiden call at Saudi Arabian port

Container vessel marks first entry into the Red Sea with call at Red Sea Gateway Terminal. |

|

|

|

||

|

Everllence to host webinars on ammonia-fuelled two-stroke engine development

Company will present B&W ME-LGIA engine technology and development journey in February sessions. |

|

|

|

||

|

Bilbao LNG terminal secures sustainability certification for bio-LNG services

Bahía de Bizkaia Gas facility gains ISCC certification, enabling renewable fuel traceability for marine bunkers. |

|

|

|

||

|

Tsuneishi Shipbuilding delivers methanol dual-fuel container vessel from China yard

Japanese shipbuilder says delivery marks expansion of alternative-fuel vessel production beyond Japan. |

|

|

|

||

|

Zhoushan becomes world's third-largest bunker port

Chinese refuelling hub overtakes Antwerp-Bruges and Fujairah to take third place in 2025. |

|

|

|

||

|

Meyer Turku completes net-zero cruise ship concept with 90% emissions cut

Finnish shipbuilder’s AVATAR project vessel design exceeds IMO targets using technologies expected by 2030. |

|

|

|

||