Lloyd's Register teams up with Penn Oak Energy to help develop LNG-fuelled ship industry

Partnership is aimed at helping companies raise capital and mitigate the risks associated with retrofitting ships fuelled by LNG.

Lloyd's Register North America, Inc. (LR) has teamed up with Penn Oak Energy Corp to help companies raise capital and mitigate the technical risks associated with retrofitting ships fuelled by liquid natural gas (LNG), by providing a one-stop-shop solution to the industry.

In a statement LR explained: "Ships that are fuelled by LNG can greatly reduce operating costs while meeting stricter environmental regulations. LNG-fuelled ships have reduced emissions (nitrogen oxide, sulphur oxide and particulate matter) as compared with heavy bunker oil and even low-sulphur marine diesel.

"Historically, the leading expense for ship operators is fuel and personnel. The challenge to building these new ships has been that shipowners are unwilling to invest in LNG-fuelled ships if supplies of LNG bunker are difficult to obtain, but that has started to change as more LNG facilities are built. LR's LNG Bunkering Infrastructural Survey 2014 indicates that major ports around the world are either planning for, or are anticipating, the wide-scale development of LNG bunkering. The other challenge for shipbuilders is the large initial capital costs to build these new ships."

Rafa Riva, Marine Business Development Manager at LR commented: "LNG as a fuel has emerged as one of the most considered choices for a new generation of vessels. The infrastructure to support this new class of ships has started to mature, and we have seen great strides in companies willing to convert their existing ships to this new fuel or constructing new ships in the U.S. Emission Control Areas. Our relationship with Penn Oak Energy will help provide the private equity to ship owners to undertake these ambitious projects, and assist those ship builders that the U.S. will need to expand this growing demand."

Arizona-based Penn Oak Energy is a developer of LNG fuel solutions for industrial clients. The company specializes in turnkey solutions that take into consideration technology, natural gas liquefaction and supply, as well as logistics and financial considerations.

The US firm, which began in land-based infrastructure finance, is offering ship owners and their fleets a fuel-procurement agreement, where they can spread the cost of the LNG conversions and the upfront capital requirements for these conversions over the life of the project.

"The reason Penn Oak Energy chose to partner with Lloyd's Register after doing a thorough review on other class societies throughout the maritime industry was that Lloyd's Register was the most experienced in LNG conversions and transport vessels," said Philip Parker, head of business development for Penn Oak Energy. "Working with Lloyd's Register and various shipyard owners throughout North America, Penn Oak Energy has been able to sign up exclusive relationships with various shipyard builders to bring their yards up to spec on certification, safety and standards required to convert ships to dual fuel solutions."

"LR is well placed to support a new fleet of gas-fuelled ships - and help them to operate safely and efficiently. For example, in response to industry demand for clarity over options for gas-fuelled readiness, LR has established clear standards describing different levels of readiness to use natural gas as a marine fuel. LR also provides training on the key practical aspects of modern LNG carriage by sea and risk management services to support safe LNG bunkering," LR said.

In a statement LR explained: "Ships that are fuelled by LNG can greatly reduce operating costs while meeting stricter environmental regulations. LNG-fuelled ships have reduced emissions (nitrogen oxide, sulphur oxide and particulate matter) as compared with heavy bunker oil and even low-sulphur marine diesel.

"Historically, the leading expense for ship operators is fuel and personnel. The challenge to building these new ships has been that shipowners are unwilling to invest in LNG-fuelled ships if supplies of LNG bunker are difficult to obtain, but that has started to change as more LNG facilities are built. LR's LNG Bunkering Infrastructural Survey 2014 indicates that major ports around the world are either planning for, or are anticipating, the wide-scale development of LNG bunkering. The other challenge for shipbuilders is the large initial capital costs to build these new ships."

Rafa Riva, Marine Business Development Manager at LR commented: "LNG as a fuel has emerged as one of the most considered choices for a new generation of vessels. The infrastructure to support this new class of ships has started to mature, and we have seen great strides in companies willing to convert their existing ships to this new fuel or constructing new ships in the U.S. Emission Control Areas. Our relationship with Penn Oak Energy will help provide the private equity to ship owners to undertake these ambitious projects, and assist those ship builders that the U.S. will need to expand this growing demand."

Arizona-based Penn Oak Energy is a developer of LNG fuel solutions for industrial clients. The company specializes in turnkey solutions that take into consideration technology, natural gas liquefaction and supply, as well as logistics and financial considerations.

The US firm, which began in land-based infrastructure finance, is offering ship owners and their fleets a fuel-procurement agreement, where they can spread the cost of the LNG conversions and the upfront capital requirements for these conversions over the life of the project.

"The reason Penn Oak Energy chose to partner with Lloyd's Register after doing a thorough review on other class societies throughout the maritime industry was that Lloyd's Register was the most experienced in LNG conversions and transport vessels," said Philip Parker, head of business development for Penn Oak Energy. "Working with Lloyd's Register and various shipyard owners throughout North America, Penn Oak Energy has been able to sign up exclusive relationships with various shipyard builders to bring their yards up to spec on certification, safety and standards required to convert ships to dual fuel solutions."

"LR is well placed to support a new fleet of gas-fuelled ships - and help them to operate safely and efficiently. For example, in response to industry demand for clarity over options for gas-fuelled readiness, LR has established clear standards describing different levels of readiness to use natural gas as a marine fuel. LR also provides training on the key practical aspects of modern LNG carriage by sea and risk management services to support safe LNG bunkering," LR said.

|

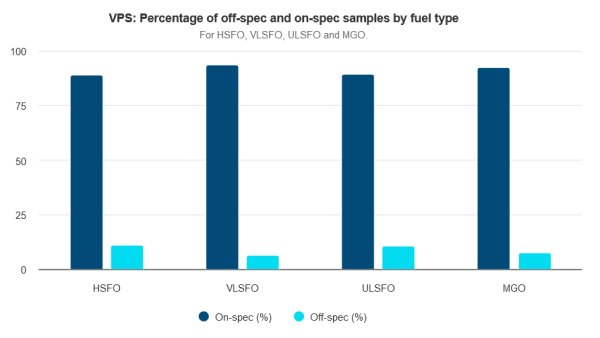

Is your vessel fully protected from the dangers of poor-quality fuel? | Steve Bee, VPS

Commercial Director highlights issues linked to purchasing fuel and testing quality against old marine fuel standards. |

|

|

|

||

|

GDE Marine targets Suape LSMGO by year-end

Expansion plan revealed following '100% incident-free' first month of VLSFO deliveries. |

|

|

|

||

|

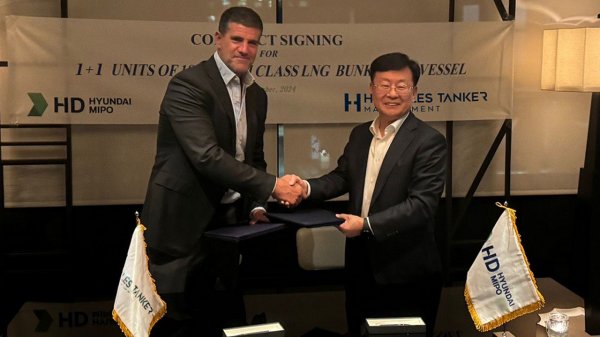

Peninsula CEO seals deal to build LNG bunker vessel

Agreement signed through shipping company Hercules Tanker Management. |

|

|

|

||

|

Auramarine supply system chosen for landmark methanol-fuelled tugs

Vessels to enter into service in mid-2025. |

|

|

|

||

|

Rise in bunker costs hurts Maersk profit

Shipper blames reroutings via Cape of Good Hope and fuel price increase. |

|

|

|

||

|

Dan-Bunkering posts profit rise in 2023-24

EBT climbs to $46.8m, whilst revenue dips from previous year's all-time high. |

|

|

|

||

|

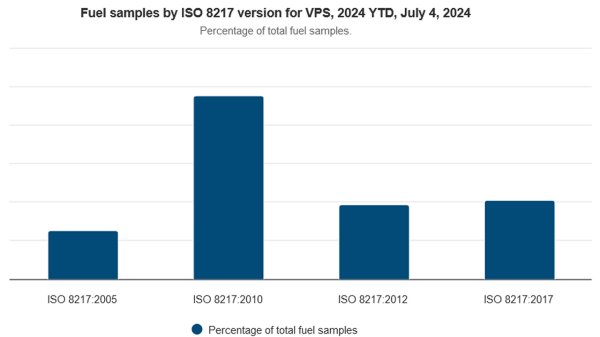

ISO 8217:2024 'a major step forward' | Steve Bee, VPS

Revision of international marine fuel standard has addressed a number of the requirements associated with newer fuels, says Group Commercial Director. |

|

|

|

||

|

EBT down 45.8% for Glander International Bunkering

CFO lauds 'resilience' as firm highlights decarbonization achievements over past year. |

|

|

|

||

|

KPI OceanConnect posts 59% drop in pre-tax profit

Diminished earnings and revenue as sales volume rises by 1m tonnes. |

|

|

|

||

|

Delta Energy's ARA team shifts to newly launched Verde Marine

Physical supplier offering delivery of marine gasoil in the ARA region. |

|

|

|

||

Related Links

- · LR introduces Gas Fuelled Readiness (GR) notation [Insights]

- · Four ports discuss harmonizing LNG bunkering standards and procedures [Insights]

- · Lloyd's Register issues emissions guidance [Insights]

- · LNG bunkering: focus on safety 'needs to be maintained' [Insights]

- · Report examines ethane-powered VLEC concept [Insights]