Lloyd's Register issues emissions guidance

Guidance is designed to support emissions compliance decision-making.

Source: Lloyd's Register

Emissions guidance issued by Lloyd's Register - compliance and performance options

With key dates looming - 2016 NOx compliance and a 2018 review of fuel availability ahead of a global cap for SOx emissions - LR's new guidelines and updated technical information is designed to support operators' investment decisions.

The new guidance addresses operational and in-service considerations reflecting further accumulated experience from working closely with clients, industry groups and regulators. As well as a focus on exhaust gas treatment (scrubbers) the guidance also examines the wider scope of options for SOx/NOx compliance beyond exhaust gas treatment.

Since an earlier version of this report was issued in 2012, early adopters of the technology - mainly passenger ship and ferry operators - have committed to fleet-wide scrubber implementation programmes. Early adopters gain valuable operational experience as well as a head start in both understanding the technology and realising any benefits.

In the majority of the tanker, bulk carrier and container segments the uptake of scrubber technology remains slow. With shorter periods inside Emission Control Areas (ECAs), lower fuel consumption (especially due to slow steaming) and typically lower asset residual values, the business case for installing scrubber technology on deep sea tank, bulk or container ships is not, yet, either strong enough or urgent enough.

The bunker price collapse during 2014 has been another factor. While the price difference between heavy fuel and distillates has remained relatively constant, the fuel costs inside ECAs have reduced giving operators more time to consider their options.

Recently, several suppliers have released new hybrid fuel products for ECA compliance. These are aimed to address the operational risks of operating on distillates but they also present several challenges of their own.

Looking ahead, there are two key years: 2016 and 2018

Ships constructed after the 1st of January 2016 will need to comply with NOx Tier III when trading to US/Canada and the guidance explores some of the technological options. Other ECAs for NOx may be introduced in the future affecting, however, only newly constructed vessels.

In 2018, IMO is due to publish a fuel availability study determining whether the global 0.50% sulphur limit will enter into force in 2020 or 2025. If it is 2020, the implications will be widespread: a possible rapid uptake of scrubber technology (with a question mark on whether supply could cover the demand) and the potential for a dramatic increase in operational costs for those who choose to operate on distillate fuels.

Whether LNG will make the leap from niche fuel to mainstream is a big question. Early adopters of LNG-as-fuel could start seeing a real return on their investment and any 'LNG-ready' ships may start converting to LNG-fuelled if and when the bunkering infrastructure develops sufficiently.

The time for decisions is fast approaching. If in 2012 the industry needed to start considering their options, today, in 2015, time is running out. The compliance options are clear. Ship operators need to evaluate compliance strategies specific to their ships, operation and risk criteria.

A PDF of 'Your options for emissions compliance' can be downloaded now from the following address:

http://www.lr.org/en/_images/213-35826_Your_options_for_emissions_compliance.pdf

Emissions guidance issued by Lloyd's Register - compliance and performance options

With key dates looming - 2016 NOx compliance and a 2018 review of fuel availability ahead of a global cap for SOx emissions - LR's new guidelines and updated technical information is designed to support operators' investment decisions.

The new guidance addresses operational and in-service considerations reflecting further accumulated experience from working closely with clients, industry groups and regulators. As well as a focus on exhaust gas treatment (scrubbers) the guidance also examines the wider scope of options for SOx/NOx compliance beyond exhaust gas treatment.

Since an earlier version of this report was issued in 2012, early adopters of the technology - mainly passenger ship and ferry operators - have committed to fleet-wide scrubber implementation programmes. Early adopters gain valuable operational experience as well as a head start in both understanding the technology and realising any benefits.

In the majority of the tanker, bulk carrier and container segments the uptake of scrubber technology remains slow. With shorter periods inside Emission Control Areas (ECAs), lower fuel consumption (especially due to slow steaming) and typically lower asset residual values, the business case for installing scrubber technology on deep sea tank, bulk or container ships is not, yet, either strong enough or urgent enough.

The bunker price collapse during 2014 has been another factor. While the price difference between heavy fuel and distillates has remained relatively constant, the fuel costs inside ECAs have reduced giving operators more time to consider their options.

Recently, several suppliers have released new hybrid fuel products for ECA compliance. These are aimed to address the operational risks of operating on distillates but they also present several challenges of their own.

Looking ahead, there are two key years: 2016 and 2018

Ships constructed after the 1st of January 2016 will need to comply with NOx Tier III when trading to US/Canada and the guidance explores some of the technological options. Other ECAs for NOx may be introduced in the future affecting, however, only newly constructed vessels.

In 2018, IMO is due to publish a fuel availability study determining whether the global 0.50% sulphur limit will enter into force in 2020 or 2025. If it is 2020, the implications will be widespread: a possible rapid uptake of scrubber technology (with a question mark on whether supply could cover the demand) and the potential for a dramatic increase in operational costs for those who choose to operate on distillate fuels.

Whether LNG will make the leap from niche fuel to mainstream is a big question. Early adopters of LNG-as-fuel could start seeing a real return on their investment and any 'LNG-ready' ships may start converting to LNG-fuelled if and when the bunkering infrastructure develops sufficiently.

The time for decisions is fast approaching. If in 2012 the industry needed to start considering their options, today, in 2015, time is running out. The compliance options are clear. Ship operators need to evaluate compliance strategies specific to their ships, operation and risk criteria.

A PDF of 'Your options for emissions compliance' can be downloaded now from the following address:

http://www.lr.org/en/_images/213-35826_Your_options_for_emissions_compliance.pdf

|

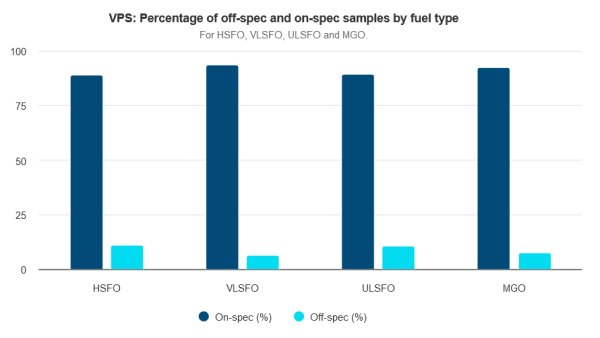

Is your vessel fully protected from the dangers of poor-quality fuel? | Steve Bee, VPS

Commercial Director highlights issues linked to purchasing fuel and testing quality against old marine fuel standards. |

|

|

|

||

|

GDE Marine targets Suape LSMGO by year-end

Expansion plan revealed following '100% incident-free' first month of VLSFO deliveries. |

|

|

|

||

|

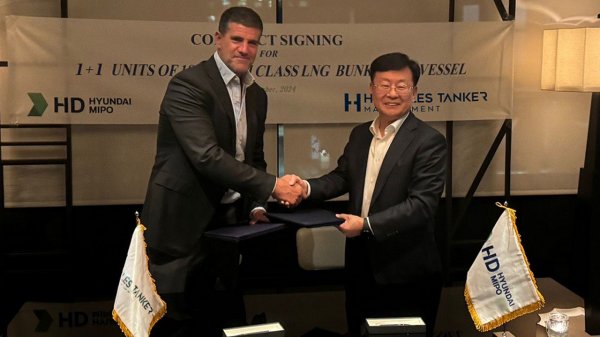

Peninsula CEO seals deal to build LNG bunker vessel

Agreement signed through shipping company Hercules Tanker Management. |

|

|

|

||

|

Auramarine supply system chosen for landmark methanol-fuelled tugs

Vessels to enter into service in mid-2025. |

|

|

|

||

|

Rise in bunker costs hurts Maersk profit

Shipper blames reroutings via Cape of Good Hope and fuel price increase. |

|

|

|

||

|

Dan-Bunkering posts profit rise in 2023-24

EBT climbs to $46.8m, whilst revenue dips from previous year's all-time high. |

|

|

|

||

|

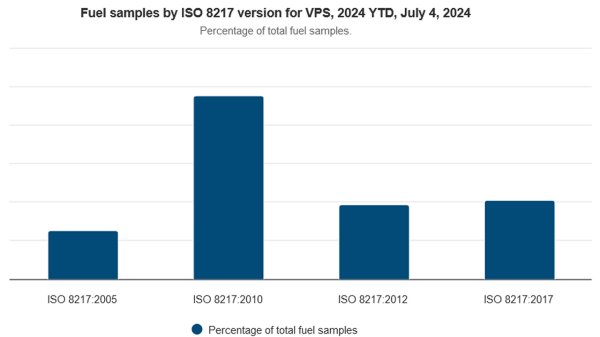

ISO 8217:2024 'a major step forward' | Steve Bee, VPS

Revision of international marine fuel standard has addressed a number of the requirements associated with newer fuels, says Group Commercial Director. |

|

|

|

||

|

EBT down 45.8% for Glander International Bunkering

CFO lauds 'resilience' as firm highlights decarbonization achievements over past year. |

|

|

|

||

|

KPI OceanConnect posts 59% drop in pre-tax profit

Diminished earnings and revenue as sales volume rises by 1m tonnes. |

|

|

|

||

|

Delta Energy's ARA team shifts to newly launched Verde Marine

Physical supplier offering delivery of marine gasoil in the ARA region. |

|

|

|

||

Related Links

- · New fuel changeover calculator launched [Insights]

- · Approval in principle for gas turbine-powered LNG carrier design [Insights]

- · LR introduces Gas Fuelled Readiness (GR) notation [Insights]

- · LNG bunkering: focus on safety 'needs to be maintained' [Insights]

- · Report examines ethane-powered VLEC concept [Insights]

- · United Kingdom [Directory]