|

German ferry operator TT-Line cuts CO2 emissions with bio-LNG switch

TT-Line reports emissions reduction after operating two Baltic Sea ferries on bio-LNG throughout 2025. |

|

|

|

||

|

CMA CGM vessel completes record biomethanol bunkering in Yangshan

Delivery marks first time a vessel in its fleet has operated on biomethanol. |

|

|

|

||

|

Pres-Vac highlights tanker valve compliance requirements for alternative fuels

Company outlines regulatory standards and performance criteria for pressure-vacuum relief devices on methanol and ammonia vessels. |

|

|

|

||

|

ABS and HD Hyundai partner on nuclear propulsion for container ships

Classification society and South Korean shipbuilder to assess feasibility for 16,000-teu vessel. |

|

|

|

||

|

Japan Engine Corporation extends ammonia engine licence to Akasaka Diesels

J-ENG grants domestic partner rights to manufacture alternative-fuel engines for decarbonisation efforts. |

|

|

|

||

|

DNV to host webinar on FuelEU Maritime compliance strategies

Classification society offers insights as first reporting period closes and verification phase begins. |

|

|

|

||

|

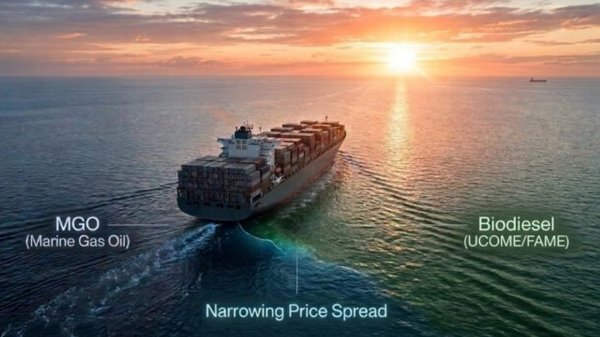

Biodiesel–MGO price spread narrows to $400–500/mt in Northwest Europe

Bunker One says tighter spread creates opportunities for shipping companies pursuing decarbonisation targets. |

|

|

|

||

|

Exmar to discuss ammonia-fuelled vessel operations in webinar

Shipowner will explore safety measures and partnerships for new dual-fuel ammonia carriers. |

|

|

|

||

|

Skuld reports engine damage from CNSL biofuel blends amid rising alternative fuel adoption

Marine insurer details operational challenges with biofuels, including FAME, CNSL and UCOME across member vessels. |

|

|

|

||

|

GRM and Bunker Holding to host webinar on Middle East war's impact on energy markets

Webinar on 9 March will examine effects on crude oil, bunker and gas markets. |

|

|

|

||

| NCL suspends fuel supplement [News & Insights] |

| Antarctic fuel ban: cruise lines pull out [News & Insights] |

| Cruise visits to hit peak in Gothenburg [News & Insights] |

| New terminal provides shore power to two ships at once [News & Insights] |