|

Global Fuel Supply unveils Blue Alliance tanker after Dubai upgrade works

Marine fuel supplier completes intermediate survey and technical upgrades on vessel ahead of operational service. |

|

|

|

||

|

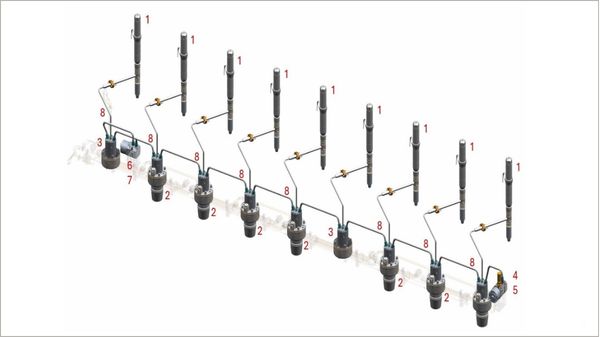

Everllence common-rail technology surpasses 20 million operating hours

Engine maker’s common-rail systems reach milestone across 600 engines and 5,500 cylinders over 18 years. |

|

|

|

||

|

LR Advisory appointed by Geogas Trading to develop FuelEU Maritime compliance strategy

Lloyd’s Register division to support charterer with emissions planning and FuelEU pooling operationalisation. |

|

|

|

||

|

ICS survey shows maritime leaders favour LNG as industry awaits IMO net-zero vote

Barometer reveals strategic shift towards conservative fuel choices amid regulatory uncertainty over decarbonisation framework. |

|

|

|

||

|

Petrobras bunker operations to close for Carnival, with higher prices during holiday period

Brazilian headquarters shut 16-18 February; Rotterdam office to handle new sales during closure. |

|

|

|

||

|

Maersk container ship returns to Suez Canal as Gemini Cooperation reroutes ME-11 service

Astrid Maersk becomes third Maersk vessel to transit canal since strategic partnership agreement signed. |

|

|

|

||

|

Petredec invests in Carnot Engines to accelerate LPG-fuelled engine development

Partnership aims to deploy high-efficiency engines across transport, maritime and power generation sectors. |

|

|

|

||

|

LD Armateurs launches first of three wind-assisted RoRo vessels for Airbus transatlantic route

Spirit of Toulouse features Norsepower rotor sails and dual-fuel engines capable of running on methanol. |

|

|

|

||

|

Flex Commodities appoints Akshat Agrawal as operations manager

Dubai-based marine fuel trader adds experienced operations professional to support global expansion. |

|

|

|

||

|

Peninsula lauds appointment of Jeroen De Vos as IBIA vice chair

De Vos has served on the bunker industry association’s board of directors since 2023. |

|

|

|

||

| Aegean claims up to $300m of company assets were misappropriated [News & Insights] |

| Aegean reveals management changes: President to step down in November [News & Insights] |

| Mercuria HK firm now owns 17.458m shares in Aegean Marine [News & Insights] |

| Sealed in a month: Mercuria takes 30% stake in Aegean as refinancing transaction is agreed [News & Insights] |

| Aegean Marine gets extra 90 days to avoid note default [News & Insights] |