BP tie-up to develop fuel oil trading

Singapore-listed firm aims to strengthen its cooperation with BP in the area of fuel oil trading.

China Aviation Oil (Singapore) Corp (CAO) is planning to strengthen its cooperation with oil major BP Plc in the area of fuel oil and diesel trading, according to CAO chief executive officer Meng Fanqiu.

Singapore-listed CAO is the largest purchaser of jet fuel in the Asia Pacific region and a key supplier of imported jet fuel to the aviation industry in China.

China National Aviation Fuel Group Corporation (CNAF) is the largest single shareholder of CAO with a stake of around 51 percent. State-owned CNAF is the leading aviation transportation logistics service provider in the country, providing aviation fuel distribution, storage and refuelling services at most of the airports in mainland China.

In 2005, BP Investments Asia Limited, a subsidiary of BP, bought a 20 percent stake in CAO. Following the purchase, BP sent staff to assist CAO in the development of its aviation oil trading business.

It is understood that CAO is now planning to also develop its fuel oil trading business with the assistance of BP.

Meng said in a press conference that the supply of aviation fuel to mainland China will be still be CAO's core business in five years' time. He commented that the company is looking at developing aviation fuel sales in Hong Kong, Australia, Indonesia and Vietnam, adding that the North American and Middle East markets were also of interest.

Singapore-listed CAO is the largest purchaser of jet fuel in the Asia Pacific region and a key supplier of imported jet fuel to the aviation industry in China.

China National Aviation Fuel Group Corporation (CNAF) is the largest single shareholder of CAO with a stake of around 51 percent. State-owned CNAF is the leading aviation transportation logistics service provider in the country, providing aviation fuel distribution, storage and refuelling services at most of the airports in mainland China.

In 2005, BP Investments Asia Limited, a subsidiary of BP, bought a 20 percent stake in CAO. Following the purchase, BP sent staff to assist CAO in the development of its aviation oil trading business.

It is understood that CAO is now planning to also develop its fuel oil trading business with the assistance of BP.

Meng said in a press conference that the supply of aviation fuel to mainland China will be still be CAO's core business in five years' time. He commented that the company is looking at developing aviation fuel sales in Hong Kong, Australia, Indonesia and Vietnam, adding that the North American and Middle East markets were also of interest.

|

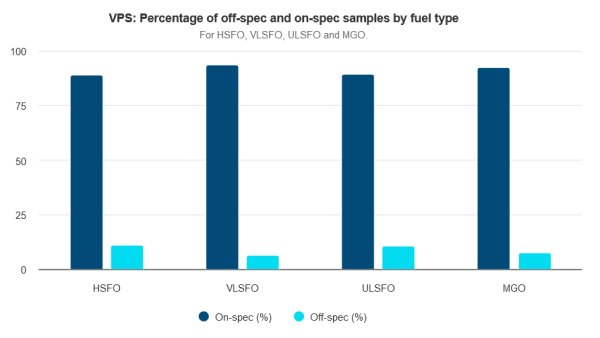

Is your vessel fully protected from the dangers of poor-quality fuel? | Steve Bee, VPS

Commercial Director highlights issues linked to purchasing fuel and testing quality against old marine fuel standards. |

|

|

|

||

|

GDE Marine targets Suape LSMGO by year-end

Expansion plan revealed following '100% incident-free' first month of VLSFO deliveries. |

|

|

|

||

|

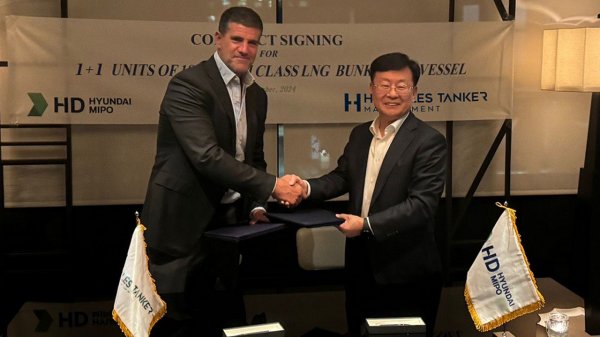

Peninsula CEO seals deal to build LNG bunker vessel

Agreement signed through shipping company Hercules Tanker Management. |

|

|

|

||

|

Auramarine supply system chosen for landmark methanol-fuelled tugs

Vessels to enter into service in mid-2025. |

|

|

|

||

|

Rise in bunker costs hurts Maersk profit

Shipper blames reroutings via Cape of Good Hope and fuel price increase. |

|

|

|

||

|

Dan-Bunkering posts profit rise in 2023-24

EBT climbs to $46.8m, whilst revenue dips from previous year's all-time high. |

|

|

|

||

|

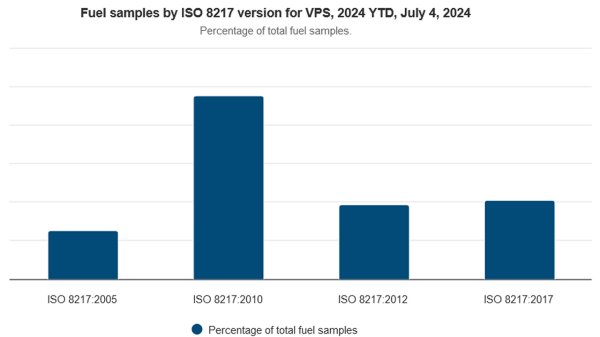

ISO 8217:2024 'a major step forward' | Steve Bee, VPS

Revision of international marine fuel standard has addressed a number of the requirements associated with newer fuels, says Group Commercial Director. |

|

|

|

||

|

EBT down 45.8% for Glander International Bunkering

CFO lauds 'resilience' as firm highlights decarbonization achievements over past year. |

|

|

|

||

|

KPI OceanConnect posts 59% drop in pre-tax profit

Diminished earnings and revenue as sales volume rises by 1m tonnes. |

|

|

|

||

|

Delta Energy's ARA team shifts to newly launched Verde Marine

Physical supplier offering delivery of marine gasoil in the ARA region. |

|

|

|

||

Related Links

- · BP countersued by former staff [Insights]

- · BP appoints Asia fuel oil traders - source [Insights]

- · BP files lawsuit against former staff [Insights]

- · BP replaces fuel oil, marine fuels staff [Insights]

- · Singapore [Directory]

- · China [Directory]