Dredging works to start on Changxing Island

Project to prepare land for oil storage facility project in Liaoning Province.

Brightoil Dalian Storage, a wholly-owned subsidiary of Brightoil-New, has entered into a Dredging and Reclamation Contract with China Communications Construction in relation to dredging and reclamation works in the Changxing Island Harbour Industrial Zone located on Changxing Island, Dalian City, Liaoning Province.

As part of the agreement, China Communications Construction has agreed to carry out dredging and reclamation works on the land. The total contract is said to be worth RMB180 million (approximately US$26.3 million).

The news follows the announcement made in August last year that Brightoil Petroleum had entered into a legally binding investment agreement with the Industrial Zone Management Committee to jointly establish Brightoil Dalian Storage for the construction and operation of projects on Changxing Island.

As part of the agreement, both parties also agreed to establish Brightoil Dalian Port, a joint venture company, which would be 60 percent owned by Brightoil Petroleum and 40 percent owned by a company invested by the Industrial Zone Management Committee for the construction and operation of a wharf project. Once competed, the wharf will comprise of 13-15 berths and will require an investement of around US$160 million.

Brightoil said last year that it plans to invest US$887 million to build an oil storage facility on Changxing Island. The new facility is expected to have a capacity of around 8 million cubic meters and will be used to store fuel oil, diesel fuel, aviation fuel, chemical products and crude oil.

Brightoil is also understood to be planning to build a 192.6-kilometer pipeline to link the storage facility with the national pipeline.

Expansion Plans

Earlier this year, Brightoil Petroleum (Holdings) Ltd. said it was planning to purchase up to eight oil transportation vessels in 2010.

The company is said to be in the market to buy six to eight tankers between 50,000 deadweight tonnes (dwt) and 300,000 dwt in size, all during the course of 2010.

The plan forms part of Brightoil's strategy to expand its marine transportation business, aiming to take advantage of the current low price of oil tankers during the current economic climate.

As part of the agreement, China Communications Construction has agreed to carry out dredging and reclamation works on the land. The total contract is said to be worth RMB180 million (approximately US$26.3 million).

The news follows the announcement made in August last year that Brightoil Petroleum had entered into a legally binding investment agreement with the Industrial Zone Management Committee to jointly establish Brightoil Dalian Storage for the construction and operation of projects on Changxing Island.

As part of the agreement, both parties also agreed to establish Brightoil Dalian Port, a joint venture company, which would be 60 percent owned by Brightoil Petroleum and 40 percent owned by a company invested by the Industrial Zone Management Committee for the construction and operation of a wharf project. Once competed, the wharf will comprise of 13-15 berths and will require an investement of around US$160 million.

Brightoil said last year that it plans to invest US$887 million to build an oil storage facility on Changxing Island. The new facility is expected to have a capacity of around 8 million cubic meters and will be used to store fuel oil, diesel fuel, aviation fuel, chemical products and crude oil.

Brightoil is also understood to be planning to build a 192.6-kilometer pipeline to link the storage facility with the national pipeline.

Expansion Plans

Earlier this year, Brightoil Petroleum (Holdings) Ltd. said it was planning to purchase up to eight oil transportation vessels in 2010.

The company is said to be in the market to buy six to eight tankers between 50,000 deadweight tonnes (dwt) and 300,000 dwt in size, all during the course of 2010.

The plan forms part of Brightoil's strategy to expand its marine transportation business, aiming to take advantage of the current low price of oil tankers during the current economic climate.

|

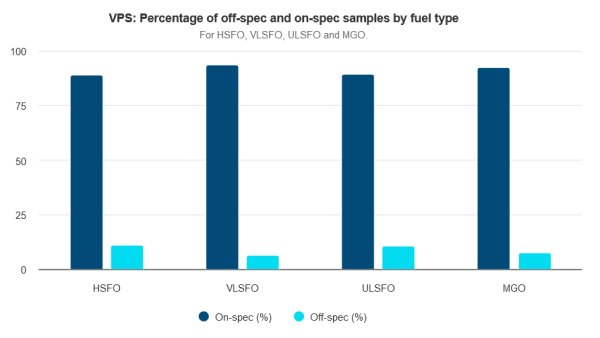

Is your vessel fully protected from the dangers of poor-quality fuel? | Steve Bee, VPS

Commercial Director highlights issues linked to purchasing fuel and testing quality against old marine fuel standards. |

|

|

|

||

|

GDE Marine targets Suape LSMGO by year-end

Expansion plan revealed following '100% incident-free' first month of VLSFO deliveries. |

|

|

|

||

|

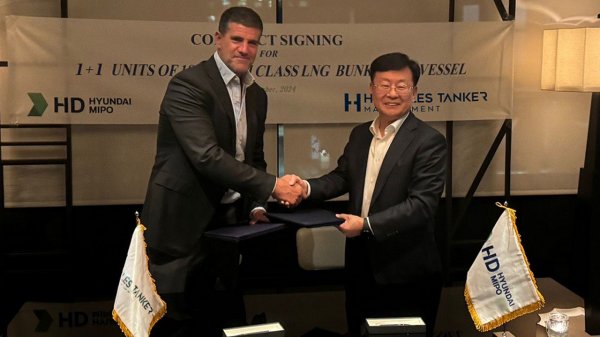

Peninsula CEO seals deal to build LNG bunker vessel

Agreement signed through shipping company Hercules Tanker Management. |

|

|

|

||

|

Auramarine supply system chosen for landmark methanol-fuelled tugs

Vessels to enter into service in mid-2025. |

|

|

|

||

|

Rise in bunker costs hurts Maersk profit

Shipper blames reroutings via Cape of Good Hope and fuel price increase. |

|

|

|

||

|

Dan-Bunkering posts profit rise in 2023-24

EBT climbs to $46.8m, whilst revenue dips from previous year's all-time high. |

|

|

|

||

|

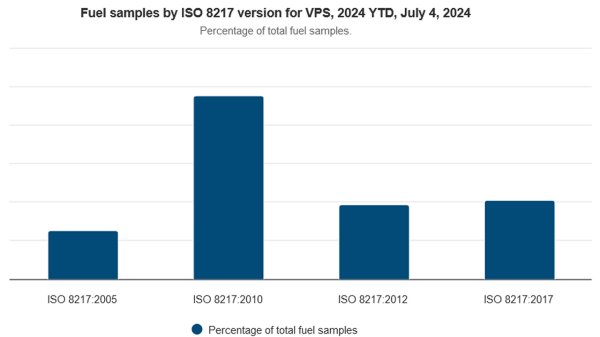

ISO 8217:2024 'a major step forward' | Steve Bee, VPS

Revision of international marine fuel standard has addressed a number of the requirements associated with newer fuels, says Group Commercial Director. |

|

|

|

||

|

EBT down 45.8% for Glander International Bunkering

CFO lauds 'resilience' as firm highlights decarbonization achievements over past year. |

|

|

|

||

|

KPI OceanConnect posts 59% drop in pre-tax profit

Diminished earnings and revenue as sales volume rises by 1m tonnes. |

|

|

|

||

|

Delta Energy's ARA team shifts to newly launched Verde Marine

Physical supplier offering delivery of marine gasoil in the ARA region. |

|

|

|

||

Related Links

- · Brightoil takes delivery of ocean-going tanker [Insights]

- · Brightoil leases tank storage in Singapore [Insights]

- · Brightoil plans to expand tanker fleet in 2010 [Insights]

- · Brightoil Petroleum announces 2008/09 results [Insights]

- · China [Directory]