Oil firm offers February 380-cst cargo

30,000-tonne parcel is scheduled for loading at the beginning of next month.

India's Bharat Petroleum Corp Ltd. (BPCL) has issued a tender for the sale of 30,000-tonnes of fuel oil for delivery next month.

The 380-centistoke (cst) cargo is scheduled for loading from the port of Mumbai on February 1-5 on a free-on-board (FOB) basis. The tender is due to close on January 11th.

The oil refinery's latest tender comes only a week after it sold two 380-centistoke (cst) parcels, each 30,000- 40,000 tonnes in size. They are scheduled for loading on January 10-14 from the port of Mumbai and January 20-24 from Kochi. Bharat reportedly sold the lots to Sharjah-based fuel oil trader FAL Oil and oil major Shell at a discount of $15 and $13 per tonne to Singapore spot quotes on a free-on-board (FOB) basis.

Last month Bharat Petroleum issued a tender for the prompt sale of 30,000 tonnes of fuel oil scheduled for loading from Kochi on December 22-24 on a free on board (FOB) basis. Bunker supplier Chemoil bought the cargo at a discount of $16.00-$17.00 a tonne to spot quotes, FOB, traders said.

Bharat also recently sold two similar-sized lots for loading from Mumbai on December 15-21 and from Kochi on December 27-31. The parcels were understood to have been purchased by FAL Oil and Shell at discounts of $11.00-$15.00 a tonne to Singapore spot quotes on a free-on-board (FOB) basis.

Bharat Petroleum is a rare spot seller of fuel oil cargoes as it normally supplies the majority of its term cargoes to its joint venture partner Matrix Bharat Marine Services, which sells marine fuel at the world's leading bunker port, Singapore.

However, over the past month Bharat has now sold 150,000-180,000 tonnes of fuel oil cargoes for December and January lifting. The change in strategy is said to be because the company recently acquired competitively priced sour crude on term, which it has been using to produce more fuel oil.

The 380-centistoke (cst) cargo is scheduled for loading from the port of Mumbai on February 1-5 on a free-on-board (FOB) basis. The tender is due to close on January 11th.

The oil refinery's latest tender comes only a week after it sold two 380-centistoke (cst) parcels, each 30,000- 40,000 tonnes in size. They are scheduled for loading on January 10-14 from the port of Mumbai and January 20-24 from Kochi. Bharat reportedly sold the lots to Sharjah-based fuel oil trader FAL Oil and oil major Shell at a discount of $15 and $13 per tonne to Singapore spot quotes on a free-on-board (FOB) basis.

Last month Bharat Petroleum issued a tender for the prompt sale of 30,000 tonnes of fuel oil scheduled for loading from Kochi on December 22-24 on a free on board (FOB) basis. Bunker supplier Chemoil bought the cargo at a discount of $16.00-$17.00 a tonne to spot quotes, FOB, traders said.

Bharat also recently sold two similar-sized lots for loading from Mumbai on December 15-21 and from Kochi on December 27-31. The parcels were understood to have been purchased by FAL Oil and Shell at discounts of $11.00-$15.00 a tonne to Singapore spot quotes on a free-on-board (FOB) basis.

Bharat Petroleum is a rare spot seller of fuel oil cargoes as it normally supplies the majority of its term cargoes to its joint venture partner Matrix Bharat Marine Services, which sells marine fuel at the world's leading bunker port, Singapore.

However, over the past month Bharat has now sold 150,000-180,000 tonnes of fuel oil cargoes for December and January lifting. The change in strategy is said to be because the company recently acquired competitively priced sour crude on term, which it has been using to produce more fuel oil.

|

Peninsula to receive first of four tankers in Q2 2025

Methanol-ready vessels form part of bunker supplier's fleet renewal programme. |

|

|

|

||

|

Stephen Robinson heads up bunker desk at Tankers International

Former Bomin and Cockett MD appointed Head of Bunker Strategy and Procurement. |

|

|

|

||

|

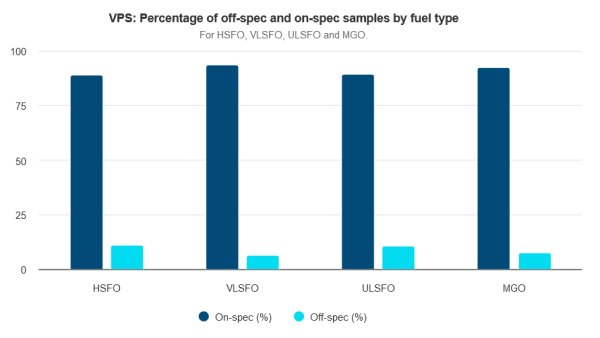

Is your vessel fully protected from the dangers of poor-quality fuel? | Steve Bee, VPS

Commercial Director highlights issues linked to purchasing fuel and testing quality against old marine fuel standards. |

|

|

|

||

|

GDE Marine targets Suape LSMGO by year-end

Expansion plan revealed following '100% incident-free' first month of VLSFO deliveries. |

|

|

|

||

|

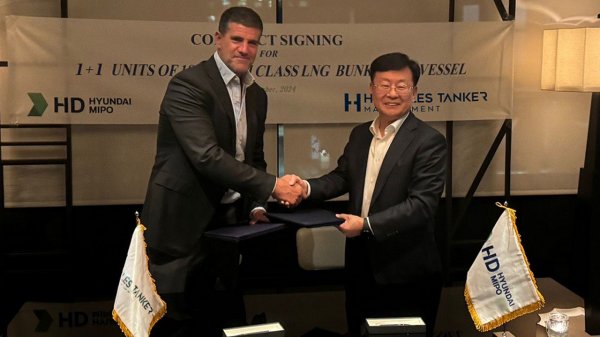

Peninsula CEO seals deal to build LNG bunker vessel

Agreement signed through shipping company Hercules Tanker Management. |

|

|

|

||

|

Auramarine supply system chosen for landmark methanol-fuelled tugs

Vessels to enter into service in mid-2025. |

|

|

|

||

|

Rise in bunker costs hurts Maersk profit

Shipper blames reroutings via Cape of Good Hope and fuel price increase. |

|

|

|

||

|

Dan-Bunkering posts profit rise in 2023-24

EBT climbs to $46.8m, whilst revenue dips from previous year's all-time high. |

|

|

|

||

|

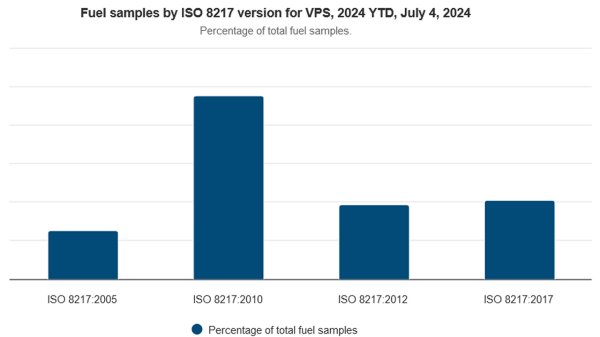

ISO 8217:2024 'a major step forward' | Steve Bee, VPS

Revision of international marine fuel standard has addressed a number of the requirements associated with newer fuels, says Group Commercial Director. |

|

|

|

||

|

EBT down 45.8% for Glander International Bunkering

CFO lauds 'resilience' as firm highlights decarbonization achievements over past year. |

|

|

|

||

Related Links

- · Matrix Bharat begins bunker operations in Mumbai [Insights]

- · 380-cst cargoes offered for January loading [Insights]

- · Kochi bunker terminal project gathers pace [Insights]

- · India [Directory]

- · Mumbai [Directory]