|

Stolt-Nielsen, through its subsidiary Stolt-Nielsen Gas, has entered into a share purchase agreement to acquire all the shares of LNG bunker supplier Avenir LNG Limited owned by Golar LNG and Aequitas Limited — the Høegh family's investment holding company.

The transaction is expected to be finalized during the first quarter of 2025. Upon completion, Stolt-Nielsen Gas is set to control approximately 94.37% of the outstanding shares and votes in Avenir LNG.

As part of the deal, Golar LNG sold its stake in Avenir LNG to Stolt-Nielsen for $40m, but it will remain a 25% shareholder and debt provider to Higas Srl, a small-scale LNG storage terminal in Sardinia, Italy, that was spun off from Avenir LNG in October 2024.

As of end October 2024, the book value of Higas was $40.5m, of which $24.7m was shareholder loans and $15.8m shareholders equity.

Avenir LNG is a leading supplier of LNG and liquefied biomethane (Bio LNG) as marine fuel. It is the owner of five LNG bunkering vessels, with two newbuildings under construction.

Of the five vessels currently in operation, the 20,000-cbm Avenir Achievement, the 7,500-cbm Avenir Advantage and 7,500-cbm Avenir Accolade are chartered to Shell, PETCO Trading Labuan Company Ltd (PTLCL), a trading arm of Petronas, and NFE Transport Partners, a subsidiary of New Fortress Energy, respectively.

The 7,500-cbm Avenir Aspiration, which has been trading alongside the Avenir Ascension in Northwest Europe — performing small-scale supply services and ship-to-ship bunkering operations for Avenir's London-based physical LNG trading division, Avenir Supply and Trading — has recently been leased to LNG Shipping S.p.A., a wholly owned subsidiary of Eni, in a multi-year time charter commencing in 2025.

The Avenir Ascension, also with a 7,500-cbm capacity, is chartered by Avenir Supply and Trading.

As regards the two as-yet-unnamed ships under construction with Nantong CIMC Sinopacific Offshore & Engineering Co. Ltd (CIMC SOE), both with a 20,000-cbm capacity, they are scheduled to be delivered in Q4 2026 and Q1 2027, respectively, with the former having been chartered by Vitol.

Commenting on the transaction, Udo Lange, CEO of Stolt-Nielsen, said: "This strategic move not only strengthens our position in the LNG sector but also underscores our commitment to pursuing more sustainable energy solutions for the maritime, industrial, and power generation markets."

Jonathan Quinn, Managing Director Avenir LNG, remarked: "Today marks an exciting new chapter for Avenir LNG as we continue to execute our strategy to become the leading small-scale LNG shipping and trading company."

"With the increased support from Stolt-Nielsen Limited, Avenir LNG is well positioned to act dynamically as we pursue our growth strategy in this burgeoning market," Quinn added.

Golar CEO, Karl-Fredrik Staubo, commented: "The sale of Golar’s shareholding in Avenir LNG is in line with our strategy to focus on expanding our market-leading FLNG position. Golar is proud to have founded Avenir LNG into one of the largest small-scale LNG shipping companies globally alongside our partners Stolt Nielsen and Höegh. Following the sale of Hygo Energy Transition Ltd. in 2021, our Avenir LNG investment was no longer deemed a core asset of Golar's portfolio. We wish the Avenir LNG team and Stolt-Nielsen all the best for the future development of Avenir."

Subject to completion of the transaction, Stolt-Nielsen Gas is set to offer to buy the shares of all remaining shareholders in Avenir LNG, Stolt-Nielsen said.

|

Ammonia emerges as most feasible alternative fuel for deep-sea shipping in 2050 emissions study

Research combining expert survey and technical analysis ranks ammonia ahead of hydrogen and methanol. |

|

|

|

||

|

EMSA study examines biodiesel blend spill response as shipping adopts alternative fuels

Research addresses knowledge gaps on biodiesel-conventional fuel blends as marine pollutants and response measures. |

|

|

|

||

|

BIMCO adopts ETS clause for bareboat charters, delays biofuel provision

BIMCO’s Documentary Committee has approved an emissions trading compliance clause while requesting further work on a biofuel charter provision. |

|

|

|

||

|

BIMCO and Norwegian Shipbrokers’ Association launch SALEFORM 2025 ship sale contract

Updated agreement addresses banking changes, compliance requirements and environmental regulations affecting vessel transactions. |

|

|

|

||

|

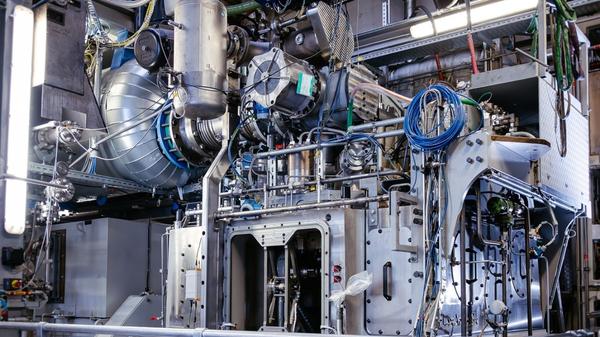

Everllence develops hydrogen test bench for marine engines

German engine maker upgrades Augsburg facility under HydroPoLEn project backed by federal maritime research funding. |

|

|

|

||

|

CMA CGM names 13,000-teu methanol-fuelled containership in South Korea

CMA CGM Osmium to operate on Asia–Mexico service as part of the carrier’s decarbonisation strategy. |

|

|

|

||

|

NorthStandard publishes biofuel guide as marine insurance claims emerge

White paper addresses quality issues and compliance requirements as biofuel testing volumes surge twelvefold. |

|

|

|

||

|

Maritime fuel platform calls for EU shipping ETS revenues to fund clean fuel deployment

Clean Maritime Fuels Platform urges earmarking of national emissions trading revenues for renewable fuel infrastructure. |

|

|

|

||

|

Lloyd’s Register grants approval for hybrid nuclear power design for amphibious vessels

Classification society approves Seatransport’s concept integrating micro modular reactors with diesel-electric systems. |

|

|

|

||

|

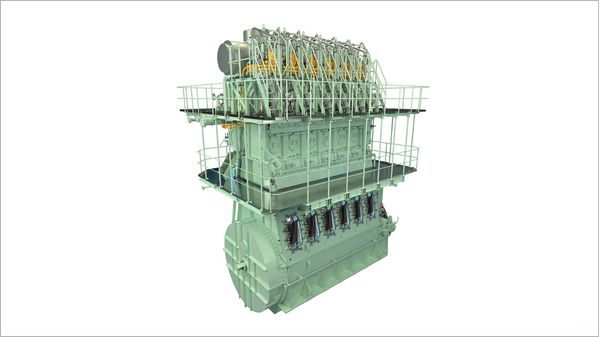

Everllence and Vale partner on ethanol-powered marine engine development

Brazilian mining company to develop dual-fuel ethanol engines based on ME-LGI platform. |

|

|

|

||

| Peninsula CEO seals deal to build LNG bunker vessel [News & Insights] |

| Wärtsilä to supply Scale Gas LNG bunker vessel's cargo handling system [News & Insights] |

| Stolt-Nielsen Gas chief bullish on firm's future role in LNG bunkering [News & Insights] |