|

Glander International Bunkering (GIB) has posted a 45.8% drop in earnings before tax (EBT) to $22.17m for the 2023-24 fiscal year, with annual revenue of $3.23bn, a 25% return on equity and a 21% solvency ratio.

The decline in pre-tax profit follows the record high of $40.9m seen in 2022-23, and the latest annual figure is the lowest since the $18.5m achieved in 2020-21.

Commenting on the results, CFO David Varghese said: "As shown by our numbers, we were able to maintain a financially healthy organization because of our resilience, adaptability and commitment to our maritime partners."

Annual profit before tax with YoY changes for Glander International Bunkering, 2018/19 - 2023/24

Profit before tax in $m.

| Year | Profit before tax ($m) | Change ($m) | Change (%) |

|---|---|---|---|

| 2018-19 | 15.74 | ||

| 2019-20 | 27.30 | 11.6 | 73.4 |

| 2020-21 | 18.50 | -8.8 | -32.2 |

| 2021-22 | 29.80 | 11.3 | 61.1 |

| 2022-23 | 40.90 | 11.1 | 37.2 |

| 2023-24 | 22.17 | -18.7 | -45.8 |

Reflecting on the last two fiscal periods, CEO Carsten Ladekjær said 2022-23 was marked by extreme volatility, price hikes and supply disruptions due to political events, whilst in 2023-24, shipping and bunkering experienced a notable return to normalization with energy prices dropping to stable levels.

GIB noted that demand in 2023-24 was affected by sanctions on specific shipping trades, with Ladekjær emphasizing the role his company played in assisting clients affected by trade disruption in routes covering the Red Sea and Panama Canal.

New fuels and decarbonization

As regards the energy transition, GIB underlined some of its key achievements during the past year: its six ISCC-certified offices; coordinating Hamina's first-ever terminal-to-ship LNG bunker supply by pipeline; collaborating on Kokkola's first LNG supply; helping to coordinate the supply of B100 HVO to a seismic survey vessel in Algeciras; performing the first biofuel supply to asphalt tanker client Rubis; and providing EUA procurement and advisory services to customers.

Ladekjær commented: "Our commitment to decarbonization, innovation and regulatory guidance is not just a strategy, it's a fundamental part of our business ethos. It's an opportunity to lead as a partner that facilitates and simplifies the way for clients and suppliers."

|

Maersk and Hapag-Lloyd suspend Strait of Hormuz transits amid Middle East security crisis

Container carriers reroute services around the Cape of Good Hope as military conflict escalates. |

|

|

|

||

|

Operations continue as normal at most Middle East ports

Most facilities operating normally, with exceptions in Oman and Saudi Arabia. |

|

|

|

||

|

Naftomar takes delivery of 93,000-cbm dual-fuel ammonia carrier

Gaz Ronin features a MAN dual-fuel engine with high-pressure selective catalytic reduction technology. |

|

|

|

||

|

AYK Energy completes world’s largest marine battery retrofit on Wasaline ferry

Aurora Botnia receives 10.4 MWh battery system, bringing total capacity to 12.6 MWh. |

|

|

|

||

|

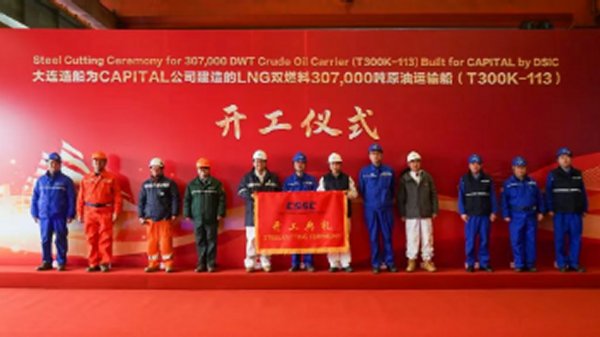

Dalian Shipbuilding begins construction on LNG dual-fuel crude tanker

Development is one of a number of milestones reported by parent company over the past few days. |

|

|

|

||

|

Sallaum Lines launches Blue Corridor sustainability initiative for Europe–Africa ro-ro trade

Company deploys LNG-capable vessels with AI routing and eco-speed protocols on new green shipping corridor. |

|

|

|

||

|

Eidesvik Offshore signs yard contract for ammonia retrofit of PSV Viking Energy

Halsnøy Dokk to convert platform supply vessel as part of EU-backed Apollo project. |

|

|

|

||

|

North Sea Port completes risk analysis for alternative fuel bunkering operations

Port authority says LNG, hydrogen, methanol and ammonia can be safely refuelled across its facilities. |

|

|

|

||

|

Ammonia emerges as most feasible alternative fuel for deep-sea shipping in 2050 emissions study

Research combining expert survey and technical analysis ranks ammonia ahead of hydrogen and methanol. |

|

|

|

||

|

EMSA study examines biodiesel blend spill response as shipping adopts alternative fuels

Research addresses knowledge gaps on biodiesel-conventional fuel blends as marine pollutants and response measures. |

|

|

|

||

| Rubis receives first biofuel delivery [News & Insights] |

| KPI OceanConnect posts 59% drop in pre-tax profit [News & Insights] |