|

Transport & Environment welcomes STIP but warns action needed by 2026 to secure e-fuels leadership

EU transport plan takes steps to boost green fuel production for ships and planes. |

|

|

|

||

|

DNV claims nuclear propulsion could offer viable route to maritime decarbonisation

Classification society publishes white paper examining technological, regulatory, and commercial challenges facing nuclear-powered merchant vessels. |

|

|

|

||

|

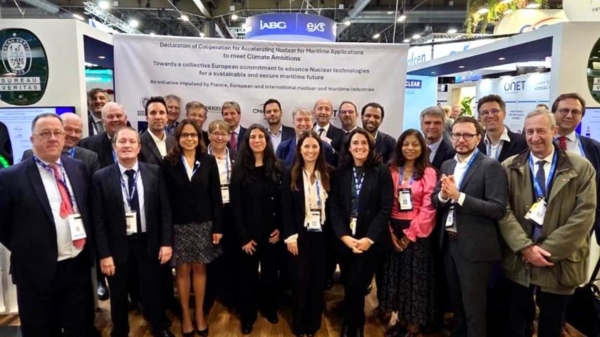

European nuclear declaration signed for maritime decarbonisation

Over 30 companies sign cooperation agreement to advance small modular reactor technologies for shipping. |

|

|

|

||

|

Peninsula operates Omega barge for fuel supply in Belgian North Sea

Victrol vessel said to be the only estuary barge of its size serving Belgian North Sea ports. |

|

|

|

||

|

Sonan Energy Panama unveils new logo as part of sustainable energy transition

Bunker firm introduces redesigned brand identity reflecting shift towards cleaner energy solutions. |

|

|

|

||

|

Stena Line to acquire Wasaline ferry operations in Baltic Sea expansion

Swedish ferry operator signs deal to take over Umeå–Vaasa route with bio-LNG-powered vessel. |

|

|

|

||

|

Berg Propulsion secures second Arriva retrofit after 10% fuel savings confirmed

Norwegian shipowner orders second propulsion upgrade following verified efficiency gains on general cargo vessel Norjarl. |

|

|

|

||

|

Bunker Holding to absorb Baseblue into KPI OceanConnect by April 2026

Integration follows earlier Hong Kong merger and aims to streamline operations and strengthen regional teams. |

|

|

|

||

|

CPN unveils new brand identity after 34 years in marine fuel supply

Hong Kong bunker supplier launches rebrand centered on 'continuous evolution' and sustainable fuel solutions. |

|

|

|

||

|

Flex Commodities hires Aicha Azad as trader in Dubai

Bunker firm appoints multilingual trader with bunker trading and cargo operations experience. |

|

|

|

||

| Oil firm issues fuel oil tender [News & Insights] |

| Fuel oil exports up in Saudi Arabia [News & Insights] |

| Oil firm imports 780,000 mt of HSFO [News & Insights] |