|

Bebeka seeks bunker trader for Groningen office

Shipping cooperative advertises role supporting global fuel supply and energy transition. |

|

|

|

||

|

ScanOcean launches biofuel pooling solution with Ahti Climate

Bunker supplier targets FuelEU Maritime compliance with pool-in-pool arrangement for shipowners. |

|

|

|

||

|

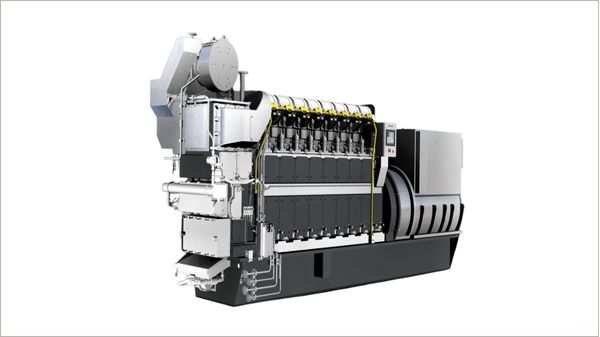

Everllence confirms ethanol operation on 21/31 four-stroke engine

Engine builder says tests in Denmark validated fuel flexibility of methanol-capable platform. |

|

|

|

||

|

Mediterranean states adopt roadmap for low-carbon shipping transition

REMPEC welcomes decisions on emissions control areas and offshore pollution monitoring. |

|

|

|

||

|

Molgas secures bioenergy certification for biogas and biomethane

Spanish energy company claims certification enables full supply chain traceability for customers. |

|

|

|

||

|

Monjasa seeks supply bunker trader for Singapore operations

Danish bunker supplier expands trading team in Asia's largest bunkering hub. |

|

|

|

||

|

Bound4blue secures $44m funding to scale suction sail production

Wind propulsion specialist raises capital from maritime and climate investors to industrialise manufacturing capacity. |

|

|

|

||

|

Landmark methanol-powered bunkering vessel departs shipyard

World's first methanol-powered IMO II chemical bunker tanker begins operations after completion of construction phase. |

|

|

|

||

|

Monjasa mourns death of senior trader Paul Pappaceno

Marine fuel supplier to hold celebration of life for 39-year industry veteran. |

|

|

|

||

|

Imabari delivers 13,900-teu container ship with future-fuel readiness

Japanese shipbuilder hands over One Synergy with methanol and ammonia conversion designs approved. |

|

|

|

||