|

Christiania Energy relocates headquarters within Odense Harbour

Bunker firm moves to larger waterfront office to accommodate growing team and collaboration needs. |

|

|

|

||

|

HD Hyundai Heavy Industries receives design approval for 20,000-cbm LNG bunkering vessel

Bureau Veritas grants approval in principle following joint development project with South Korean shipbuilder. |

|

|

|

||

|

Peninsula outlines dual role in FuelEU Maritime compliance at Lloyd’s Register panel

Marine fuel supplier discusses challenges for shipowners and opportunities for suppliers under new regulation. |

|

|

|

||

|

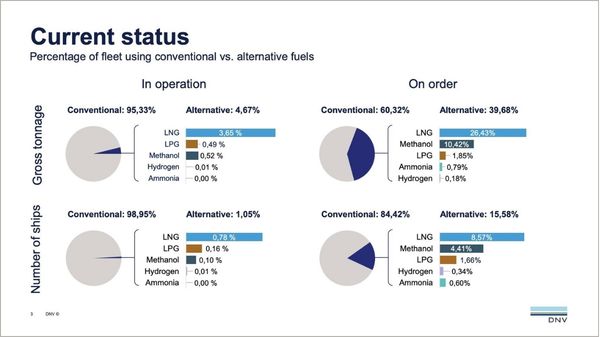

LNG-fuelled container ships dominate January alternative-fuel vessel orders

Container ships accounted for 16 of 20 alternative-fuelled vessels ordered in January, DNV reports. |

|

|

|

||

|

GCMD and CIMAC sign partnership to advance alternative marine fuel readiness

Two-year agreement aims to bridge operational experience with technical standards for decarbonisation solutions. |

|

|

|

||

|

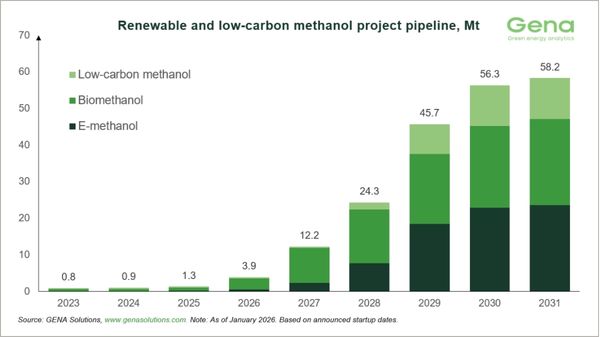

Renewable methanol project pipeline reaches 58.2m tonnes by 2031, GENA reports

Project Navigator Methanol tracks 275 projects, including e-methanol, biomethanol and low-carbon methanol facilities globally. |

|

|

|

||

|

Petrobras adjusts bunker pricing and minimum order volumes at Santos

Brazilian supplier discontinues volume discount tier and lowers minimum order quantity from 1 March. |

|

|

|

||

|

Viking Line secures biogas supply for 2026 after tenfold increase in biofuel use

Åland-based ferry operator aims to maintain 50% biogas blend throughout the year on two vessels. |

|

|

|

||

|

GNV takes delivery of second LNG-powered vessel Aurora from Chinese shipyard

Vessel to enter service on Genoa–Palermo route in April, completing first fleet renewal phase. |

|

|

|

||

|

Maersk takes delivery of first methanol-capable vessel in 9,000-teu series

Tangier Maersk is the first of six mid-size container ships with methanol-capable dual-fuel engines. |

|

|

|

||

| Aegean completes repurchase of founder's shares [News & Insights] |

| Aegean founder set to bank $99.6m from share sale [News & Insights] |

| Aegean Marine Petroleum earnings call summary [News & Insights] |

| Aegean reduces costs to achieve profit rise despite lower revenue [News & Insights] |

| Aegean deploys bunker vessel to Port Elizabeth [News & Insights] |