|

Gram Marine delivers first marine lubricants in San Lorenzo

Operation follows recent strategic partnerships with LPC and Servi Río. |

|

|

|

||

|

Halten Bulk orders wind-assisted bulk carriers with rotor sails from Chinese yard

Norwegian operator contracts two vessels with options for two more at SOHO Marine. |

|

|

|

||

|

IBIA introduces enhanced KYC framework for membership applications

Trade association to use Baltic Exchange platform for sanctions screening and company verification. |

|

|

|

||

|

Servi Río joins Gram Marine and Cyclon alliance for Argentina lube operations

Argentine company to provide storage and transportation services for lubricant products in local market. |

|

|

|

||

|

IMO seminar examines biofuels’ role in maritime decarbonisation

Event drew 700 in-person and virtual participants, with 1,300 more following the online broadcast. |

|

|

|

||

|

Hapag-Lloyd to acquire ZIM for $4.2bn in cash deal

German container line signs agreement to buy Israeli rival, subject to regulatory approvals. |

|

|

|

||

|

VPS outlines key features of Maress 2.0 with enhanced analytics for offshore vessel efficiency

Updated platform adds data validation, energy flow diagrams and fleet comparison tools for decarbonisation monitoring. |

|

|

|

||

|

IMO committee agrees NOx certification rules for ammonia and hydrogen engines

DNV reports PPR 13 also advanced a biofouling framework and crude oil tanker emission controls. |

|

|

|

||

|

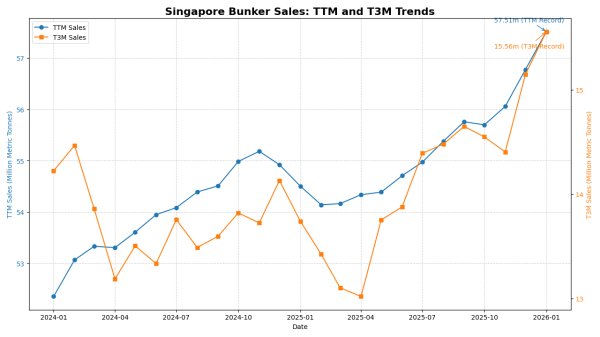

Singapore bunker sales set new record as TTM volumes surpass 57.5 tonnes

Rolling 12-month bunker sales at the Port of Singapore have reached a fresh all-time high, breaking above 57.5 million tonnes for the first time, alongside a record surge in short-term demand. |

|

|

|

||

|

PIL’s LNG-powered Kota Odyssey makes maiden call at Saudi Arabian port

Container vessel marks first entry into the Red Sea with call at Red Sea Gateway Terminal. |

|

|

|

||

| Finnlines to fit newly acquired ship with scrubbers [News & Insights] |

| Foreship predicts up to 30% of shipping will choose scrubbers [News & Insights] |

| DFDS bookends century of ships with PureSOx scrubbers [News & Insights] |

| Quadrise expects to start combustion boiler trial in early 2018 [News & Insights] |

| Wartsila CEO highlights NCL engine and scrubber order [News & Insights] |