Mitsui O.S.K. Lines (MOL) reports that net income jumped JPY 620.955bn ($4.849bn) to JPY 714.154bn ($5.578bn) during the fiscal year ending March 31. This was despite a 64.8 percent year-on-year (YoY) increase in the average bunker price.

The mean price of all major fuel grades purchased increased by $230 to $585 per tonne between April 2021 and March 2022.

MOL noted that its ferry and coastal ro-ro business saw a YoY deterioration in profit, reflecting rising bunker prices.

In its outlook for the current financial year, MOL predicts an average price of $650 per tonne for high-sulphur fuel oil (HSFO) and $810 per tonne for very-low-sulphur fuel oil (VLSFO).

| Period | 2021-22 | 2020-21 |

| Apr-Jun | 497 | 255 |

| Apr-Sep | 514 | 296 |

| Apr-Dec | 539 | 315 |

| Apr-Mar | 585 | 355 |

Key financial results and developments

In its key financials for 2021-22, MOL's revenue climbed JPY 277.884bn ($2.17bn), or 28.0 percent, to JPY 1,269.310bn ($9.913bn) as net income reached JPY 714.154bn ($5.578bn); and the Japanese shipper swung into the black with an operating profit of JPY 55.005bn ($429.6m), compared with the previous year's loss of JPY 5.303bn ($41.4m).

As regards the balance sheet, assets as at March 31 were JPY 2,686.701bn ($20.983bn), liabilities stood at JPY 1,351.835bn ($10.558bn) and equity at JPY 1,334.866bn ($10.425bn).

MOL said its LNG carrier division generated stable profit mainly through existing long-term charter contracts in addition to profit from the delivery of a new LNG carrier and an LNG bunkering vessel posting a year-on-year rise in profit.

Forecast for 2022-23

For the fiscal year ending March 31, 2023, MOL forecasts shareholder profit will fall by JPY 208.819bn ($1.63bn), or 29.5 percent, to JPY 500bn ($3.91bn), whilst operating profit is estimated at JPY 46bn ($359.3m) — a YoY decline of JPY 9.005bn ($70.3m), or 16.4 percent.

Revenue, meanwhile, is predicted to climb JPY 83.69bn ($653.6m), or 6.6 percent, to JPY 1,353bn ($10.567bn).

Commenting on the year ahead, MOL said: "In the fiscal year ending March 2023, there is a risk that our company's businesses will be affected by factors such as the risk of an economic downturn caused by increasing global inflation and fluctuations in transportation demand resulting from the Russia-Ukraine situation. In the dry bulk carrier and energy transportation business, our company is mainly engaged in medium- to long-term contracts. Therefore, fluctuations in the business cycle and transportation demand are expected to have a relatively small impact on business performance.

"However, fluctuations in market conditions and cargo movements are expected to have a certain impact on our business performance for some short-term contracts. In the product transportation business including containerships, although the direct impact on cargo movement from the situation in Russia and Ukraine is limited, we anticipate that there will be a phase in which transportation demand will weaken due to the slowdown of the world economy or the impact on parts procurement and logistics."

|

UK's first commercial biomethanol bunkering service launches at Immingham

Exolum, Methanex and Ørsted partner to supply biomethanol for shipping at the UK's largest port by tonnage. |

|

|

|

||

|

Vitol Bunkers launches HSFO supply in Pakistan after four-year hiatus

Company resumes high-sulphur fuel oil bunkering at three Pakistani ports following earlier VLSFO and LSMGO launches. |

|

|

|

||

|

CIMC SOE secures orders for three LNG bunkering vessels

Chinese shipbuilder adds two 20,000 cbm and one 18,900 cbm LNG bunkering vessels to order book. |

|

|

|

||

|

Lehmann Marine to supply battery systems for Hamburg’s first electric ferries

German firm wins contract for three 3.8 MWh systems for HADAG vessels entering service in 2028. |

|

|

|

||

|

Viking Line green corridor project marks two years with biogas use and shore power progress

Turku-Stockholm route partnership reports tenfold increase in renewable biogas use and advancing electrification infrastructure. |

|

|

|

||

|

Global Fuel Supply unveils Blue Alliance tanker after Dubai upgrade works

Marine fuel supplier completes intermediate survey and technical upgrades on vessel ahead of operational service. |

|

|

|

||

|

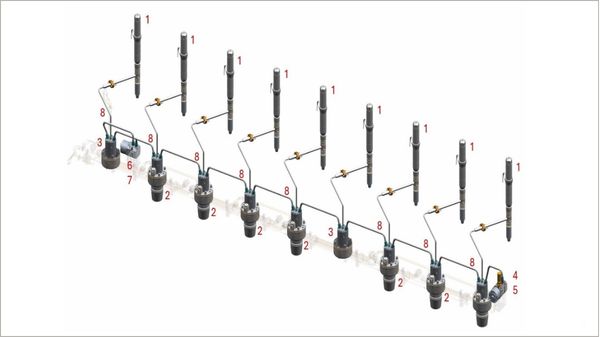

Everllence common-rail technology surpasses 20 million operating hours

Engine maker’s common-rail systems reach milestone across 600 engines and 5,500 cylinders over 18 years. |

|

|

|

||

|

LR Advisory appointed by Geogas Trading to develop FuelEU Maritime compliance strategy

Lloyd’s Register division to support charterer with emissions planning and FuelEU pooling operationalisation. |

|

|

|

||

|

ICS survey shows maritime leaders favour LNG as industry awaits IMO net-zero vote

Barometer reveals strategic shift towards conservative fuel choices amid regulatory uncertainty over decarbonisation framework. |

|

|

|

||

|

Petrobras bunker operations to close for Carnival, with higher prices during holiday period

Brazilian headquarters shut 16-18 February; Rotterdam office to handle new sales during closure. |

|

|

|

||

| Total launches huge-capacity LNG bunker vessel [News & Insights] |

| Hapag sees $270m rise in bunker costs [News & Insights] |

| Norden's bunker costs up $101m in 2021 [News & Insights] |

| Maersk spent $1.5bn more on bunkers in 2021 [News & Insights] |