|

TFG Marine calls for digital transformation to manage alternative fuel risks

CFO says transparency and digital solutions are essential as the marine fuels sector faces volatility from diversification. |

|

|

|

||

|

Reganosa’s Mugardos terminal adds bio-LNG bunkering for ships and trucks

Spanish facility obtains EU sustainability certification to supply renewable fuel with 92% lower emissions. |

|

|

|

||

|

Growth Energy joins Global Ethanol Association as new member

US biofuel trade association represents nearly 100 biorefineries and over half of US ethanol production. |

|

|

|

||

|

H2SITE explains decision to establish Bergen subsidiary

Ammonia-to-hydrogen technology firm says Norwegian city was obvious choice for its ambitions. |

|

|

|

||

|

Gibraltar Port Authority issues severe weather warning for gale-force winds and heavy rain

Port authority warns of storm-force gusts of up to 50 knots and rainfall totals reaching 120 mm. |

|

|

|

||

|

Christiania Energy relocates headquarters within Odense Harbour

Bunker firm moves to larger waterfront office to accommodate growing team and collaboration needs. |

|

|

|

||

|

HD Hyundai Heavy Industries receives design approval for 20,000-cbm LNG bunkering vessel

Bureau Veritas grants approval in principle following joint development project with South Korean shipbuilder. |

|

|

|

||

|

Peninsula outlines dual role in FuelEU Maritime compliance at Lloyd’s Register panel

Marine fuel supplier discusses challenges for shipowners and opportunities for suppliers under new regulation. |

|

|

|

||

|

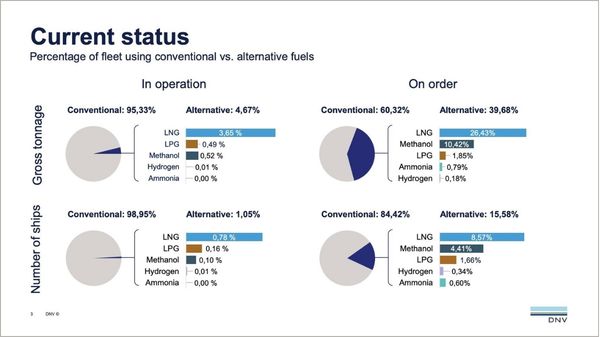

LNG-fuelled container ships dominate January alternative-fuel vessel orders

Container ships accounted for 16 of 20 alternative-fuelled vessels ordered in January, DNV reports. |

|

|

|

||

|

GCMD and CIMAC sign partnership to advance alternative marine fuel readiness

Two-year agreement aims to bridge operational experience with technical standards for decarbonisation solutions. |

|

|

|

||