|

Lloyd’s Register grants approval for hybrid nuclear power design for amphibious vessels

Classification society approves Seatransport’s concept integrating micro modular reactors with diesel-electric systems. |

|

|

|

||

|

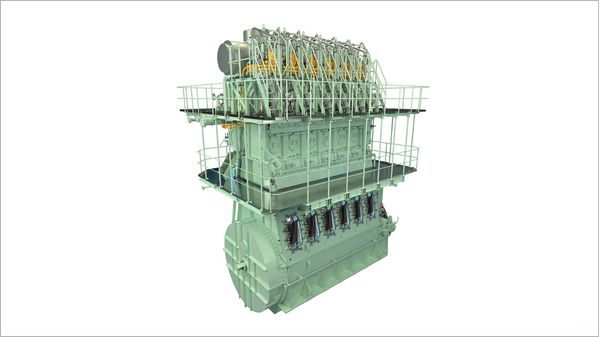

Everllence and Vale partner on ethanol-powered marine engine development

Brazilian mining company to develop dual-fuel ethanol engines based on ME-LGI platform. |

|

|

|

||

|

Emvolon highlights biomethanol as a solution to unlock India’s biogas potential

Company says distributed biogas-to-biomethanol production could bridge rural feedstock with maritime fuel demand. |

|

|

|

||

|

Grimaldi's Grande Svezia makes inaugural Le Havre call with ammonia-ready design

Second of 10 new-generation PCTCs features 5 MWh battery system and cold ironing capability. |

|

|

|

||

|

Kongsberg Maritime to supply integrated systems for LS Marine Solution cable lay vessel

Norwegian technology provider wins contract for ultra-large vessel being built at Tersan Shipyard in Türkiye. |

|

|

|

||

|

Synergy Marine takes on management of methanol dual-fuel container vessel

The 5,915-teu Maersk Finisterre joins Synergy's fleet under technical management from Synergy Pacific. |

|

|

|

||

|

Verde Marine Energy appoints Steve Taylor as UK director

Taylor will be based on the River Humber, working with Vertom Group businesses. |

|

|

|

||

|

Mitsubishi Shipbuilding delivers first ammonia fuel supply systems for marine engines

Systems shipped to Japan Engine Corporation for integration with an ammonia-fuelled marine engine. |

|

|

|

||

|

Power2X acquires HyCC to expand green hydrogen portfolio in the Netherlands and Germany

Deal consolidates clean molecules sector as projects transition from development to large-scale delivery phase. |

|

|

|

||

|

RFOcean signs binding e-methanol supply deal with ETFuels from 2030

European shipping company secures fixed-price green fuel ahead of escalating EU maritime emissions penalties. |

|

|

|

||

| WFS posts record marine profits [News & Insights] |

| WFS posts record marine segment profits [News & Insights] |

| World Fuel Services to acquire assets of Texor Petroleum [News & Insights] |