|

Malik Supply seeks bunker trader for Fredericia office

Danish company advertises role focusing on client portfolio development and energy product trading. |

|

|

|

||

|

Chimbusco Pan Nation seeks credit analysts for Asia-Pacific and Middle East expansion

Bunker firm recruiting for Hong Kong, Singapore, and Shanghai offices with APAC and MENA focus. |

|

|

|

||

|

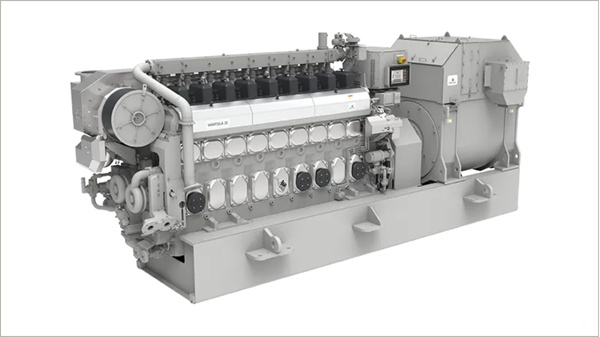

Wärtsilä to supply biodiesel-capable engines for AMAGGI's two new Amazon pusher tugs

Brazilian operator orders fuel-flexible engines for vessels designed to push 20 barges on inland waterways. |

|

|

|

||

|

Amasus installs second bound4blue wind sail on general cargo vessel

Dutch shipowner installs what is said to be the largest suction sail ever fitted to a general cargo vessel. |

|

|

|

||

|

Burando Energies appoints Vasileios Analytis as commercial director in Dubai

Marine fuel trader promoted following expanded trading activity and commercial development. |

|

|

|

||

|

J-ENG starts development of methanol-fuelled marine engine

Japanese engine maker targets 2027 completion for UEC50LSJM model following ammonia and hydrogen engine projects. |

|

|

|

||

|

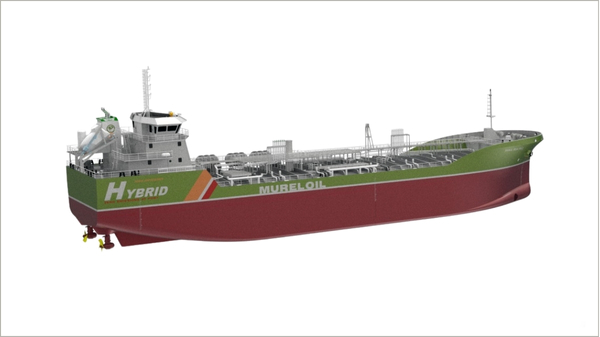

AYK Energy secures second battery contract with Mureloil for chemical tankers

Spanish ship owner orders hybrid propulsion systems for two 8,000-dwt vessels transporting biofuels and methanol. |

|

|

|

||

|

DNV approves 21,700-teu container ship design with ammonia fuel capability

Design by Zhoushan Changhong and CIMC ORIC can accommodate LNG or ammonia propulsion systems. |

|

|

|

||

|

CMB.Tech invests in Chinese ammonia supply chain ahead of fleet deliveries

Belgian shipping group secures green ammonia offtake and takes stake in Andefu supply company. |

|

|

|

||

|

UK P&I Club joins SEA-LNG coalition to support LNG marine fuel adoption

Insurer brings 50 years of LNG experience to methane pathway coalition focused on maritime decarbonisation. |

|

|

|

||

| Andatee CEO buys 13,050 shares [News & Insights] |

| More shares for Andatee CEO [News & Insights] |

| Andatee Q3 net income jumps 74 percent [News & Insights] |

| Andatee approves share repurchase plan [News & Insights] |