|

DNV to host webinar on FuelEU Maritime compliance strategies

Classification society offers insights as first reporting period closes and verification phase begins. |

|

|

|

||

|

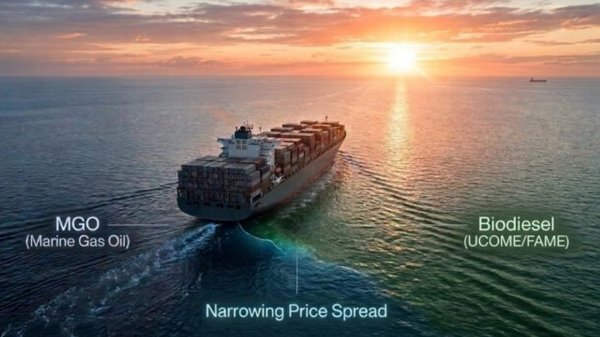

Biodiesel–MGO price spread narrows to $400–500/mt in Northwest Europe

Bunker One says tighter spread creates opportunities for shipping companies pursuing decarbonisation targets. |

|

|

|

||

|

Exmar to discuss ammonia-fuelled vessel operations in webinar

Shipowner will explore safety measures and partnerships for new dual-fuel ammonia carriers. |

|

|

|

||

|

Skuld reports engine damage from CNSL biofuel blends amid rising alternative fuel adoption

Marine insurer details operational challenges with biofuels, including FAME, CNSL and UCOME across member vessels. |

|

|

|

||

|

GRM and Bunker Holding to host webinar on Middle East war's impact on energy markets

Webinar on 9 March will examine effects on crude oil, bunker and gas markets. |

|

|

|

||

|

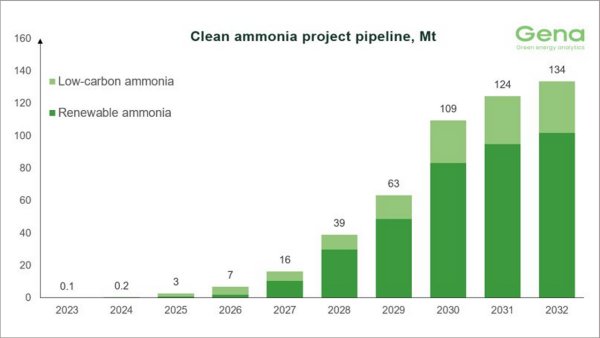

Clean ammonia project pipeline reaches 145 MMT by 2034, but delivery concerns mount

GENA Solutions reports 325 tracked projects, though over 70 have been frozen in 20 months. |

|

|

|

||

|

Peninsula highlights supply chain strength amid Strait of Hormuz closure

Marine fuel seller emphasises reliability as geopolitical disruption reshapes global bunker markets. |

|

|

|

||

|

World Shipping Council backs EU maritime strategies but calls for faster trade simplification

Industry body supports port security and decarbonisation measures while urging action on customs barriers. |

|

|

|

||

|

Anemoi and Lloyd’s Register call for unified approach to wind propulsion performance verification

Anemoi Marine Technologies and Lloyd’s Register publish paper advocating alignment of verification methodologies. |

|

|

|

||

|

Smyril Line's methanol-ready ro-ro launched in China

First of two 3,300 lane-metre vessels floated out for Faroese operator. |

|

|

|

||

| Oil and fuel oil hedging market update [News & Insights] |