|

IBIA announces new date for mass flow meter training course in Rotterdam

Training scheduled for 12 May follows mandatory MFM implementation at Rotterdam and Antwerp-Bruges ports. |

|

|

|

||

|

Maersk and Hapag-Lloyd suspend Strait of Hormuz transits amid Middle East security crisis

Container carriers reroute services around the Cape of Good Hope as military conflict escalates. |

|

|

|

||

|

Operations continue as normal at most Middle East ports

Most facilities operating normally, with exceptions in Bahrain, Oman and Saudi Arabia. |

|

|

|

||

|

Naftomar takes delivery of 93,000-cbm dual-fuel ammonia carrier

Gaz Ronin features a MAN dual-fuel engine with high-pressure selective catalytic reduction technology. |

|

|

|

||

|

AYK Energy completes world’s largest marine battery retrofit on Wasaline ferry

Aurora Botnia receives 10.4 MWh battery system, bringing total capacity to 12.6 MWh. |

|

|

|

||

|

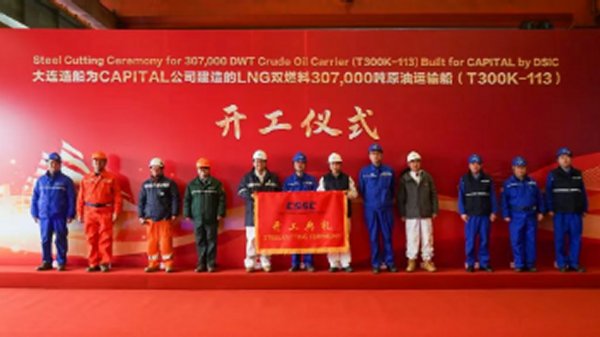

Dalian Shipbuilding begins construction on LNG dual-fuel crude tanker

Development is one of a number of milestones reported by parent company over the past few days. |

|

|

|

||

|

Sallaum Lines launches Blue Corridor sustainability initiative for Europe–Africa ro-ro trade

Company deploys LNG-capable vessels with AI routing and eco-speed protocols on new green shipping corridor. |

|

|

|

||

|

Eidesvik Offshore signs yard contract for ammonia retrofit of PSV Viking Energy

Halsnøy Dokk to convert platform supply vessel as part of EU-backed Apollo project. |

|

|

|

||

|

North Sea Port completes risk analysis for alternative fuel bunkering operations

Port authority says LNG, hydrogen, methanol and ammonia can be safely refuelled across its facilities. |

|

|

|

||

|

Ammonia emerges as most feasible alternative fuel for deep-sea shipping in 2050 emissions study

Research combining expert survey and technical analysis ranks ammonia ahead of hydrogen and methanol. |

|

|

|

||

| Oil and fuel oil hedging market update [News & Insights] |