OOIL posts loss as low bunker prices 'provide some element of cushion'

Parent company of OOCL reports loss of US$57.7 million during the first half of 2016.

Orient Overseas (International) Ltd (OOIL) - the parent company of Orient Overseas Container Line (OOCL) - has posted a loss after tax of US$57.7 million during the first six months of 2016, compared with a profit attributable to shareholders of $239 million during the corresponding period last year.

Hong Kong-listed OOIL also reported an operating loss of $19 million and a loss before tax of $47.46 million.

Commenting on the results, C.C. Tung, chairman of OOIL, said: "Market conditions in the first six months of 2016 have been difficult for the industry. Weak economic growth in many key economies has constrained consumer demand, and global uncertainty seems to have given rise to some level of slowdown in corporate and government investment. Consumer demand and investment are the key drivers of demand in our industry, and in this context it is no great surprise that cargo volume growth has been uninspiring.

"The recent UK referendum might also lead to some further delay in investment processes in the short term, at least in Europe, especially if negotiations between the UK and EU on their future trading relationship prove to be protracted. In addition, violence in Europe and geopolitical conditions in the Middle East and South China sea have injected another layer of cautiousness to sustained corporate activities and investment.

"In addition to global economic uncertainty, the industry continues to face a supply and demand imbalance. A combination of weak global growth on the demand side and excessive shipping capacity growth, exasperated by the industry's relentless pursuit for scale and efficiency in recent years, has compounded the overcapacity. The result is a weak freight market where rates fell to levels that at times failed to cover voyage costs in selected trade lanes.

"Although fuel costs have risen considerably since the remarkable lows of the first few months of 2016, they remain far lower than in recent years, and provide some element of cushion against the unsustainably low freight rates that have been seen in some trades."

The average price of bunker recorded by OOCL in the first half of 2016 was US$186 per tonne compared with US$352 per tonne for the corresponding period in 2015. In the first half of 2016, fuel costs decreased by 41 percent compared to last year.

In the first half of 2016, no newbuild vessels were delivered, and no new orders were placed by the group. Six 20,000-TEU class newbuild vessels contracted with Samsung Heavy Industries Co. Ltd. in South Korea are expected to be completed by the end of year 2017.

OOIL said its directors had not recommended the payment of an interim dividend.

Hong Kong-listed OOIL also reported an operating loss of $19 million and a loss before tax of $47.46 million.

Commenting on the results, C.C. Tung, chairman of OOIL, said: "Market conditions in the first six months of 2016 have been difficult for the industry. Weak economic growth in many key economies has constrained consumer demand, and global uncertainty seems to have given rise to some level of slowdown in corporate and government investment. Consumer demand and investment are the key drivers of demand in our industry, and in this context it is no great surprise that cargo volume growth has been uninspiring.

"The recent UK referendum might also lead to some further delay in investment processes in the short term, at least in Europe, especially if negotiations between the UK and EU on their future trading relationship prove to be protracted. In addition, violence in Europe and geopolitical conditions in the Middle East and South China sea have injected another layer of cautiousness to sustained corporate activities and investment.

"In addition to global economic uncertainty, the industry continues to face a supply and demand imbalance. A combination of weak global growth on the demand side and excessive shipping capacity growth, exasperated by the industry's relentless pursuit for scale and efficiency in recent years, has compounded the overcapacity. The result is a weak freight market where rates fell to levels that at times failed to cover voyage costs in selected trade lanes.

"Although fuel costs have risen considerably since the remarkable lows of the first few months of 2016, they remain far lower than in recent years, and provide some element of cushion against the unsustainably low freight rates that have been seen in some trades."

The average price of bunker recorded by OOCL in the first half of 2016 was US$186 per tonne compared with US$352 per tonne for the corresponding period in 2015. In the first half of 2016, fuel costs decreased by 41 percent compared to last year.

In the first half of 2016, no newbuild vessels were delivered, and no new orders were placed by the group. Six 20,000-TEU class newbuild vessels contracted with Samsung Heavy Industries Co. Ltd. in South Korea are expected to be completed by the end of year 2017.

OOIL said its directors had not recommended the payment of an interim dividend.

|

Methanol as a marine fuel | Steve Bee, VPS

How environmental legislation has driven the development of low-sulphur fuels and methanol-ready ships. |

|

|

|

||

|

Martin Vorgod elevated to CEO of Global Risk Management

Vorgod, currently CCO at GRM, will officially step in as CEO on December 1, succeeding Peder Møller. |

|

|

|

||

|

Dorthe Bendtsen named interim CEO of KPI OceanConnect

Officer with background in operations and governance to steer firm through transition as it searches for permanent leadership. |

|

|

|

||

|

Bunker Holding revamps commercial department and management team

CCO departs; commercial activities divided into sales and operations. |

|

|

|

||

|

Peninsula extends UAE coverage into Abu Dhabi and Jebel Ali

Supplier to provide 'full range of products' after securing bunker licences. |

|

|

|

||

|

Peninsula to receive first of four tankers in Q2 2025

Methanol-ready vessels form part of bunker supplier's fleet renewal programme. |

|

|

|

||

|

Stephen Robinson heads up bunker desk at Tankers International

Former Bomin and Cockett MD appointed Head of Bunker Strategy and Procurement. |

|

|

|

||

|

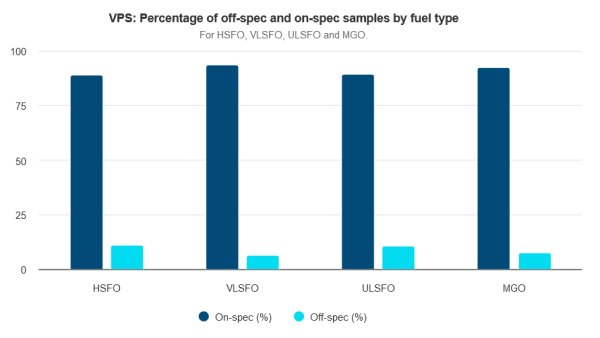

Is your vessel fully protected from the dangers of poor-quality fuel? | Steve Bee, VPS

Commercial Director highlights issues linked to purchasing fuel and testing quality against old marine fuel standards. |

|

|

|

||

|

GDE Marine targets Suape LSMGO by year-end

Expansion plan revealed following '100% incident-free' first month of VLSFO deliveries. |

|

|

|

||

|

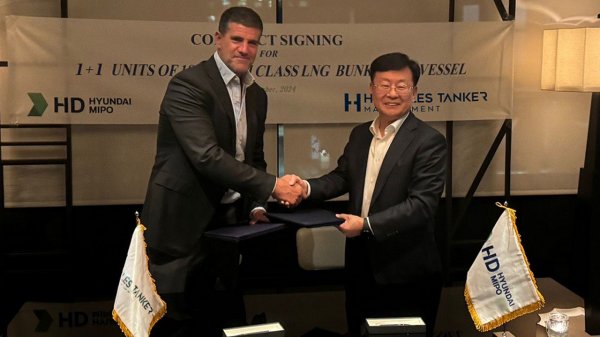

Peninsula CEO seals deal to build LNG bunker vessel

Agreement signed through shipping company Hercules Tanker Management. |

|

|

|

||

Related Links

- · OOIL: $243 drop in average bunker price [Insights]

- · Lower bunker costs help raise OOIL profits [Insights]

- · Hong Kong [Directory]